Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

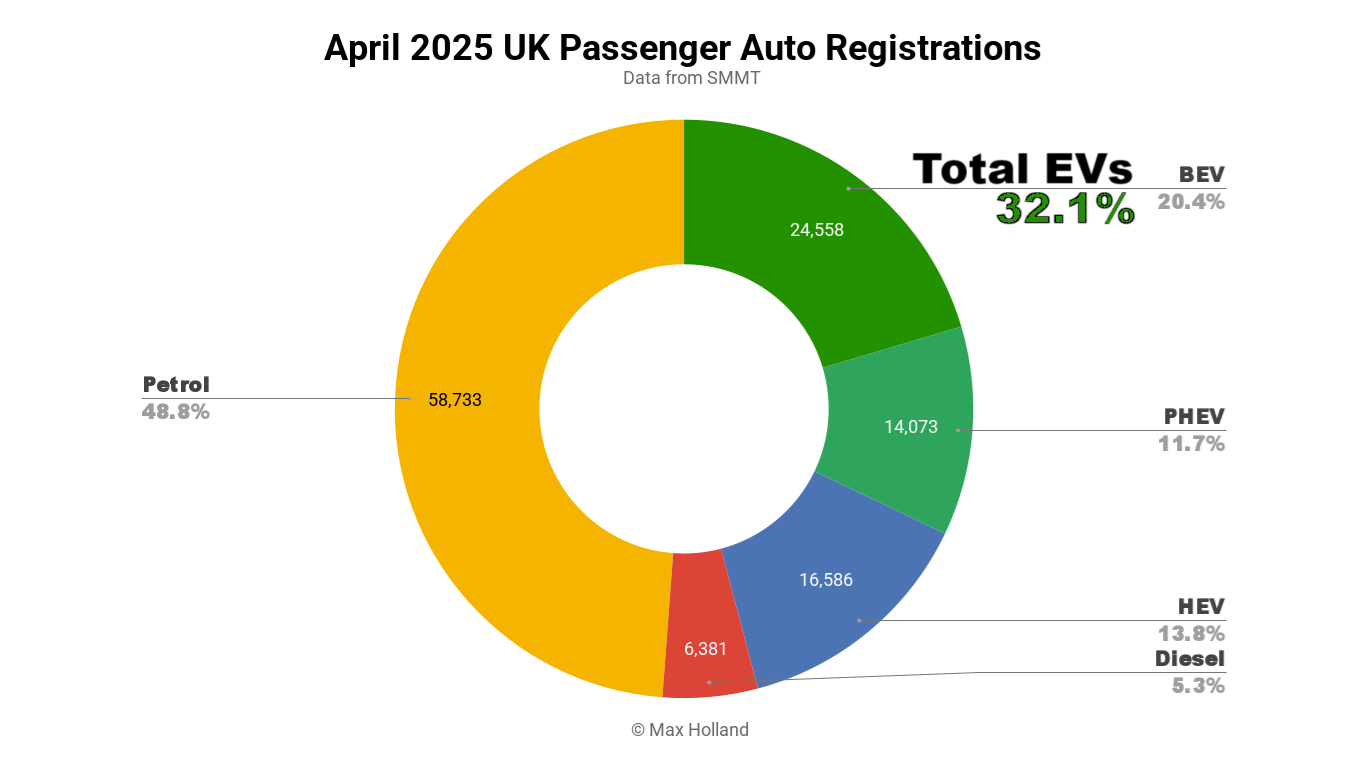

April’s auto market saw plugin EVs take 32.1% share in the UK, up from 24.7% year-on-year. BEVs grew decently, though PHEVs grew more. Overall auto volume was 120,331 units, down some 10% YoY. The UK’s leading BEV brand in April was Volkswagen, with 10.5% of the BEV market.

April’s sales totals saw combined plugin EVs take 32.1% share in the UK, with full electrics (BEVs) taking 20.4% and plugin hybrids (PHEVs) taking 11.7%. These compare with April 2024 shares of 24.7% combined, 16.9% BEV and 7.8% PHEV.

Year to date share for BEVs is at 20.7% up from 15.7% at this point last year. PHEVs are at 9.6% YTD, from 7.7% year-on-year. This growth in share is on top of overall auto volumes being up some 3% YoY.

Given that the ZEV mandate tightens this year from 2024’s headline “22%” to “28%”, the observed 5% growth in BEV share, and a slight growth in PHEV share, are in line with expectations, and — put simply – the ZEV mandate appears to be working.

To keep the powerful auto lobby happy, in early April the UK government did make some minor tweaks to the ZEV mandate going forward, allowing a little more wiggle room, and trimming fines per vehicle to £12,000 from £15,000. However, these won’t significantly change the trajectory of the EV transition, and will still keep the UK a year or two ahead of the EU-zone average.

Combustion-only powertrains lost both volume and share YoY. Petrol-only lost some 22% of volume YoY, with share falling from 55.8% down to 48.8%. Diesel-only lost 26% of volume, with share dropping from 6.4% to 5.3%. Their combined share was therefore 54.1% in April, and should drop below 50% by September, more-or-less permanently, except for perhaps an occasional blip in H1 2026.

Best Selling BEV Brands

Recall that the UK’s long-term leading BEV brand, Tesla, only begins delivery of the Model Y Juniper refresh in May, so in April lost the top spot it held in March. Volkswagen brand stepped up in April, grabbing 10.54% of the UK BEV market.

Ford made an unusual appearance in second place (with 7.36%), its highest ever UK ranking. Peugeot took third, with 7.04% share, also a higher-than-usual result for the Stellantis brand.

Ford’s step up (from 9th in Q1) is due to the tightening ZEV mandate – as one of the UK’s largest overall auto brands by volume, it has to start moving large volumes of BEVs to meet the mandate. In April, the Ford Explorer made the biggest contribution, likely followed by the new Ford Puma (our model data is a bit patchy, with many “unknown” models listed in the brand registrations, so hard to know for sure).

Skoda came in fourth place (from 11th in Q1), with the new Elroq (priced from £31,510) now widely available, selling very well, and apparently overtaking the Enyaq in volume. It was a similar story for Renault, which – largely thanks to the new Renault 5 (from £22,995) having its first big volume month (370+ units) – climbed to 9th place, from 17th place in Q1. Its sibling brand, Alpine, also saw first deliveries of the new A290 in April, a more sporty take on the Renault 5, though only at about 10% of the latter’s volume.

Tracking the most affordable BEVs; the Dacia Spring remained steady, with over 300 units, keeping Dacia in 22nd spot. Leapmotor climbed four ranks to 27th, largely thanks to the T03 selling around 60 to 70 units. Both the Spring and the T03 have MSRPs starting under ÂŁ16,000 in the UK.

Still fairly affordable, the new Hyundai Inster saw its UK debut in April, with over 200 units registered, a good start for the A-segment BEV, which is priced from £23,495. Its competitor, the Citroen e-C3 (from £21,990) took a breather in April with around 100 units (from its ~300 units in March). Bear in mind that the UK’s right-hand drive market means that models are often shipped in irregular batches, and that March anyway typically sees around 3x the volume of a normal month.

It will be interesting to watch how the Renault 5, Citroen e-C3, and Hyundai Inster compete with each other in the months ahead, and also with the BYD Dolphin Surf (aka Dolphin Mini) when the latter arrives in the coming months.

Last month’s debutant, the new MG S5 stepped up from just 15 initial units in March to 116 units in April, a decent early result. Although an SUV format, the MG S5 (from £28,495 MSRP) is effectively replacing the older MG5 wagon / tourer, whose sales have now effectively ceased.

I couldn’t detect any significant new debutant models in April, although the patchy data can obscure newcomers, let me know below if you noticed any important arrivals I may have missed.

In the trailing 3-month rankings, Tesla still holds the lead thanks to its (habitually) strong March, and despite its low-ebb April. May has already seen the new Model Y making deliveries, and we may see a surge towards the end of the month.

Meanwhile however, with a broader spread of models on offer, and less subject to erratic deliveries, the Volkswagen brand continues to erode Tesla’s lead. The two brands’ YTD share only differs by ~0.5%, and it will be interesting to see where each stands by the end of H1.

The rest of the brand ranking contains no great surprises, though BYD is steadily climbing, having stepped up a gear in 2025 compared to 2024. BYD’s popular UK models remain the Seal, Atto 3, and Dolphin. This will likely change when the Dolphin Surf arrives.

Outlook

Although April’s overall auto volume took a dip YoY, the 2025 year to date total is slightly up. We don’t yet have updated macroeconomic data since the Q4 2024 result of 1.5% YoY growth in GDP, from the Q3 figure of 1.2%. Inflation reduced to 2.6% in March (latest) from 2.8% in February. BoE interest rates have just been reduced to 4.25% in early May, from 4.5% previously. Manufacturing PMI improved slightly to 45.4 points in April, from a low of 44.9 points in March.

The UK’s economy is decidedly lacklustre, but remains strong enough to sustain the tighter ZEV targets for 2025. We saw above that the YTD trend is already as expected, given the tighter targets.

From an access-for-all point of view, I am interested to track the growth of the new generation of increasingly small-affordable-and-competent BEVs from Renault, Citroen, Hyundai and others. Which of these do you think will be most popular in the UK? Please share your thoughts and perspectives in the discussion below.

Â

Â

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy