Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

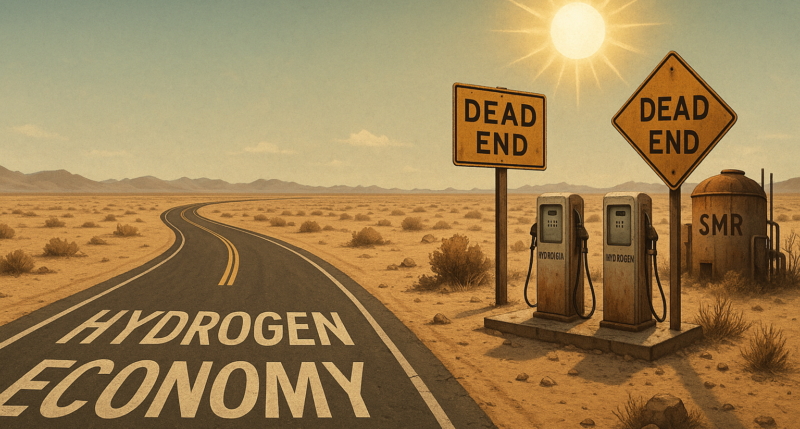

A few weeks ago, I had another opportunity to sit down with Dr. Joseph Romm, currently working with Michael Mann at the UPenn Center for Science, Sustainability, and the Media. The topic was the 20th anniversary edition of his book The Hype About Hydrogen, available now. What follows is lightly edited transcript of the first half of our conversation.

Michael Barnard [MB]: Welcome back to Redefining Energy Tech. I’m your host, Michael Barnard. My guest today is Dr. Joseph Romm, senior research fellow at the University of Pennsylvania’s Center for Science, Sustainability, and the Media. His work focuses on the sustainability, scalability, and scientific foundations of major climate solutions. The 20th anniversary edition of his book The Hype About Hydrogen is being released on Earth Day, and we’re here to talk about it. Welcome, Joe.

Joe Romm [RM]: Thanks for having me, Mike.

[MB]: Well, it’s great to have you back. We talked about BECCS and a few other things about a year and a half ago. Then, last year, you asked me to take a quick look at your book and offer any technical notes—which I did. And now, here we are—it’s coming out in just six days. Very exciting.

[RM]: It’s definitely exciting—and it was a lot of work. But the good news is that it’s a complete rewrite. As you know from reading it, I threw out about 80% of the original book and added another 60,000 words. I think readers will find it offers a clear-eyed look at the real solutions to climate change. What’s a bit unusual for a book like this is how much time I also spend on the false promises being pushed in various areas—hydrogen, small modular reactors, e-fuels, fusion, direct air capture. Not that all of these are terrible ideas, but some just aren’t good ones, and others are still a long way off. The key point is this: we need to focus on reducing emissions now, even as we invest in longer-term R&D. But the priority has to be real, immediate reductions.

[MB]: non-nerds actually like to know who’s talking and how they got there. So tell us—how did you end up working with Michael Mann, and what was your journey? I think the focus should really be on how, 20 years ago, you managed to convince people to publish a book about hydrogen. Clearly, something led up to that moment—something that made people say, “Joe’s the guy.” So maybe start with what came before the book, the lead-up to writing it, and then give us a quick look at what’s happened over the last 20 years since.

[RM]: I have a PhD in physics from MIT, and I ended up working with Amory Lovins at the Rocky Mountain Institute. When the Clinton-Gore administration came in, Amory sent a letter to the Department of Energy recommending several people for various roles. That led to me working for the Deputy Secretary of Energy at the time, Bill White. I was his Special Assistant for Policy and Planning, which meant I helped him oversee all of the DOE’s energy programs. While I did some work on the nuclear side, my main focus was the Office of Energy Efficiency and Renewable Energy—a billion-dollar office that funded the foundational research behind much of what we rely on today: solar power, wind, advanced batteries, alternative fuel vehicles, and geothermal, even way back then.

One of the things we had going at the time was a small hydrogen and fuel cell program. There were some promising breakthroughs—both at Sandia Labs and at a private company—that managed to significantly reduce the amount of platinum needed in low-temperature proton exchange membrane (PEM) fuel cells. That made them seem much more affordable, or at least plausibly affordable. Excitement started building because fuel cells, after all, take in hydrogen and output electricity, heat, and water. They were seen as a major technological promise. And it was clear to me even then that the real interest in hydrogen wasn’t about hydrogen itself—it was about using it to power fuel cells.

I was 33 at the time and still new to how things worked at the Department of Energy. Our job was to fund technologies the market wasn’t yet backing. So I, along with others, supported budget allocations for hydrogen and fuel cell development. One reason I supported it—which I touch on in the book—was that we were in discussions with AD Little about the potential for onboard gasoline reformers. The idea was, yes, you’d basically have a tiny refinery built into the car. And, pardon my lack of sophistication back then, but when a big company says, “We can do this,” it’s easy to believe them. The pitch was appealing: no need for a whole new infrastructure, just convert gasoline on board. That was the thinking at the time.

The idea was that you could go to a gas station, pump gasoline, it would be reformed into hydrogen on-site, run through a fuel cell, and you’d have no tailpipe emissions. Never mind what the reforming process itself might emit—it was supposed to be efficient. That was the theory. So the budget for hydrogen research increased—we’re talking tens of millions of dollars, which wasn’t insignificant. Looking back, we were spending a fair amount. But as you know, you can’t always pick winners. So things just kind of ambled along. That was the approach during that administration.

Then in 2003, George Bush gave a now-famous—at least for those of us who’ve been around—a State of the Union address where he announced a $1.3 billion hydrogen initiative. He claimed that a child born that year would drive a hydrogen-powered car that emitted only water. That was the moment hydrogen hit the spotlight again. You asked how I ended up writing the book—well, I went to Island Press, a nonprofit publisher, and said, “Hydrogen is a big deal again. People are talking about hydrogen cars. I’d like to write a primer.” They agreed. They’re not a commercial powerhouse like a Stephen King publisher—they focus on substance. So I dove into the research, talked to experts, and worked through the literature to get the full picture.

That’s when I realized this wasn’t going to work—especially not for cars. Then, around 1999 or 2000, AD Little came out and said, “By the way, onboard reforming isn’t going to be feasible.” Which, in hindsight, shouldn’t have been surprising—it was always unlikely. But that announcement quietly killed a critical part of the hydrogen vision, even though most people didn’t seem to notice. Without onboard reforming, you suddenly needed a full hydrogen distribution system. And not just any hydrogen—it had to be green. There was no point in replacing gasoline with hydrogen made from natural gas. That would just mean spending a lot of money for very little benefit. Maybe you’d get slightly cleaner air, but even that wasn’t clear at the time.

This was a key lesson I learned: the gasoline vehicle industry could also clean up its act. Take California’s partial zero-emission vehicle (PZEV) standard—they treated those vehicles differently, and manufacturers responded by cutting NOx emissions by 98%. Then you had the Prius, which could cut CO₂ emissions in half, all while still running on gasoline. So the entire push for alternative fuel vehicles was delayed simply because the incumbent technology improved. That was a real turning point for me. I realized I was looking at business plans for all sorts of emerging technologies that were built on the assumption that the competition would stay frozen in time. And that’s just not how the world works.

They always compare their imaginary scenario—where they hit all their cost and performance targets—with a frozen version of the competition, assuming it doesn’t improve at all. But in reality, the exact opposite happens: competing technologies advance too. Back in 2003, I wrote a book arguing that the hydrogen economy wasn’t going to happen. It faced too many obstacles. More importantly, if you could run something on electricity directly, it was a no-brainer. The math was simple: if you take renewable electricity and use it to electrolyze water, you immediately lose over 30% of the original energy. Then you have to store and transport the hydrogen, which costs more and loses even more energy.

Then you’d have to switch to a fuel cell, which meant buying another expensive system and throwing away half—or more—of the energy just to generate electricity, charge the battery, and power the electric motor. But if you could just take renewable electricity, run it through a wire, charge a battery, and discharge it into the vehicle, you’d only lose about 20%—not 80%. That means you could go a lot farther on the same amount of renewable energy. Plus, you wouldn’t need to buy an electrolyzer or a fuel cell, and you’d avoid the problem of transporting a dangerous, leaky gas everywhere. So even back in 2004 or 2005, it was pretty obvious: if you could use electricity directly, there was no reason to use hydrogen.

It became clear to me, especially when I was giving talks, that something was shifting. At the time, the electric vehicle had just failed—GM had pulled the EV1—and I was even interviewed for the documentary Who Killed the Electric Car?. But when I went to California to give some talks, I met Andy Frank, who was working on plug-in hybrids. He showed me that you didn’t need to replace the entire engine—you could just add a battery of a certain size and cover most people’s daily travel, around 40 miles. So in the paperback edition of my book, I wrote that the likely winner would be the electric vehicle, perhaps starting with the plug-in hybrid.

And it turned out to be true. I gave a lot of talks, and many people understood that hydrogen didn’t make much sense. But then—almost magically—five, six, seven, eight, even ten years ago, people started talking about hydrogen again. Nothing had changed. In fact, there are even more reasons now why it makes less sense. I watched it all unfold, and then a guy named Niall [Enright] wrote a LinkedIn review in February of last year about my old book. He said something like, “This author made some accurate predictions—you could publish this book today and it would still be relevant.” And I thought, wow—this guy thinks a 20-year-old book of mine still holds up.

I thought, why not go to Island Press and ask if they’d like me to update the book? Initially, I figured I’d just tack on a conclusion or an afterword and say, “See? Here’s how it all turned out.” But they came back and said, “No, you really need to redo this.” So I went back and read the book carefully, and realized—yeah, a lot of what made sense 20 years ago doesn’t hold up anymore. It ended up being a complete rewrite. One of the things that stood out was that now people are talking about making hydrogen from nuclear plants. Twenty years ago, that idea wasn’t even on the radar.

Anyway, I decided to take a deeper dive into small modular reactors since everyone’s talking about them. Then people started saying, “Oh, we’re also going to use hydrogen to make e-kerosene for jet fuel,” and I realized that meant I had to address the fact that a lot of these e-fuels require pulling CO₂ out of the air—that’s direct air capture. I had already written a report on that, so I brought it in. Then there was all the buzz around blue hydrogen and capturing CO₂ from steam methane reforming. And just as a side note—twenty years ago, when someone said “SMR,” they meant steam methane reformer. Now it means small modular reactor, so we’ve basically lost the acronym.

The point was, in that world, you have to deal with carbon capture and storage, which brings its own set of issues. So, in my book, I dedicate a chapter to blue hydrogen, but I don’t call it blue hydrogen—because I view it as greenwashing. It’s blue, yes, but simply looking at the sky and saying, “Oh, it’s blue, so it’s clean,” doesn’t work for me. From a CO2 perspective, blue hydrogen is far from clean, so I label it dirty in the book. This chapter also dives into carbon storage, and I included a little analysis because hydrogen is used in fusion, of course. I thought, why not throw that in for context? It was particularly relevant because the reason fusion advocates got excited about it was due to the breakthrough at the National Ignition Facility, which involved high-powered lasers.

The Department of Energy—well, when I was there, it was during the period when people were debating whether we should spend all that money on this high-powered simulation system. I bring that up because, as everyone knew, the real reason behind it was to simulate nuclear weapons tests. We can get into the details if you want, but the broader point is this: everything happens for political reasons. National security trumps everything else. We had a nuclear weapons test ban in place, so the argument became, “If we can’t test the weapons physically, you have to fund us to simulate them.” That’s how the world works—decisions wrapped in science but driven by politics.

I rewrote this book, and it’s coming out on April 22nd. You’ve read it—Niall wrote a very kind review—and I think it’s my best and most important work so far. We’re at a moment where the world is about to spend potentially a trillion dollars over the next 15 years on technologies that aren’t the real solution right now. There’s a push to scale up some technologies prematurely—some that may never scale at all, and others that still need years of serious R&D before we even know if they’re viable. We can dig into all of that, but that’s the long version of what the book’s about.

[MB]: I was recently reminded of Bruno Latour’s actor-network theory. He’s in the same intellectual space as Popper and Kuhn—those non-scientists who explored how science and technology actually function. Kuhn, of course, is famous for The Structure of Scientific Revolutions, where the now-overused term “paradigm shift” comes from. Popper gave us the idea of falsifiability, which has unfortunately been twisted by people trying to deny climate change—one of the more absurd misapplications out there. But Latour’s point is different: technology doesn’t win in the marketplace because it’s better. It wins because we convince ourselves it should. A whole network of people and institutions gather around a story—and that story becomes reality.

What he describes is a process where a group of actors—both human and non-human—gather around a shared narrative. Once they enroll in that narrative, its core assumptions become a black box. No one opens it. No one checks if what’s inside actually makes sense. The narrative becomes a self-healing bubble, drifting forward through time. The analogy I use for those old enough to remember is VHS versus Betamax. Betamax was arguably the better technology, but VHS won—until it didn’t, and something else replaced it. With hydrogen, we’ve built a massive self-reinforcing network around it. And I keep going back, doing the analysis, asking: why? Why are we still making these obviously flawed decisions?

It seems like the International Energy Agency’s first 2030 and 2050 hydrogen price projections were handed off to an intern—but they weren’t alone. The IEA in 2019 and 2020 drastically lowballed the projected cost of green hydrogen. CSIRO in Australia did the same. LUT in the Netherlands has been publishing wildly optimistic figures. Everyone bought in. The International Council on Clean Transportation was claiming $1 hydrogen. PIK in Potsdam—one of Germany’s major institutes—also projected cheap hydrogen, and those assumptions got baked into their models. The JRC in Europe followed the same pattern. They all got it wrong. Not because they couldn’t do the analysis, but because they didn’t. They wanted hydrogen to be viable, so they backcasted—asking what the price would need to be for hydrogen to work economically, and then assuming that price into their projections.

[RM]: Can I offer an alternative theory—one that comes from my experience in the DOE world? The Department of Energy, famously, around the late 2010s, would say something like, “We’re at $5 per kilogram—hypothetically, at scale.” But what they don’t tell you is that this isn’t the actual price today—it’s the imaginary price if you were already at mass production scale. So the starting number is made up. Then they project it’ll drop to $1 by 2030. That’s the DOE narrative. And it’s the same mindset applied to nuclear, direct air capture, and other speculative technologies: the assumption that they’ll follow the same steep learning curves that solar, batteries, and to a lesser extent, wind followed. But that assumption is doing a lot of heavy lifting—and it’s not grounded in how those technologies actually scale.

Bloomberg New Energy Finance—who are nobody’s fool—also projected 10% annual cost declines. But the reality is, when you look at what it takes to make hydrogen, much of it simply doesn’t follow a learning curve. Electrolyzers rely on components that are based on decades-old technology. Then there’s the cement, the steel—it’s the same story as with nuclear plants. You don’t get to magically assume you’ll ride the same cost curve as solar or batteries. And yet, every business plan seems to make that assumption. That’s the fatal flaw. The literature is clear: to come down a learning curve, certain conditions have to be met. And hydrogen just doesn’t meet them.

Manufacturing has to be truly modular and small-scale, and deployment has to be modular in the sense that it’s repeatable—not a bespoke, one-off process like carbon capture projects or nuclear plants, where every design is custom and site-specific. If you can achieve both modular manufacturing and modular deployment, then you have a shot at being like solar. But calling something modular—like “small modular reactor”—doesn’t make it so. And assuming electrolyzers will automatically get cheaper just because you’re scaling them up, expecting 10% annual cost declines, is magical thinking. Most technologies don’t follow that kind of curve. The solar and battery learning curves have fooled people into thinking it’s universal. I don’t necessarily see it as bad faith—though for some, it might be—but mostly, it’s just deeply flawed assumptions.

[MB]: I didn’t say bad faith. I called it incompetence because the analysis was there to be done—I know that because I did it. I concluded years ago that hydrogen wasn’t going to be cheap. This isn’t a technology that benefits significantly from economies of scale, and my heterodox projection—one of declining hydrogen production and demand globally—was based entirely on that premise. If hydrogen isn’t cheap, and in fact gets more expensive, that’s going to have clear implications for supply and demand. The major organizations are only now starting to adjust, slowly and reluctantly.

Some analysts out of Australia and Europe have done excellent work tracking hydrogen price point projections. What they found is that since 2020, major institutions have been slowly and incrementally raising their projections each year. The original forecasts from 2020 were off by a factor of three to four compared to actual 2024 costs. The problem was twofold: first, these organizations made overly optimistic projections, driven by hope and wishful thinking; second, they refused to fully accept the reality of the results. Instead of correcting the record, they’ve just inched their estimates upward, still anchored to those lowball early numbers. Only BNEF has openly admitted they were wrong by a factor of three—and even then, I think they’re still being optimistic.

[RM]: I’ve read the full Revision report and spoken directly with the head of their hydrogen program. Originally, they projected a 10% annual cost decline. But then reality set in—zero interest rates weren’t going to last forever, and material costs can spike. In fact, the cost of electrolyzers rose by 40% between 2020 and 2024 instead of falling by 10% a year as expected. So yes, as you noted, BNEF had to revisit their assumptions and admit their core projection was flawed. Their latest 2050 forecast suggests that, at best, costs might drop by 50%—but even that assumes free trade. Without it, the projected cost reduction is only around 28%.

The point is, in the world the President has created, it’s become very inhospitable to any new technology that relies on components sourced from multiple countries. Tariffs hurt everyone, of course—but you’re in especially deep trouble if you’re not a commercial enterprise. A commercial company can at least go to a supplier and say, “I can guarantee 10 years of purchases if you can deliver.” But if you’re not commercial yet, you can’t offer that. All you can do is say, “Please build this,” without any assurance that you’ll buy enough to make it worth their while.

So yes, if you’re an emerging technology—like small modular reactors, green hydrogen, or even blue hydrogen, which is arguably less viable than green hydrogen—then these tariffs and alienating key trading partners are a really bad idea.

[MB]: Well, I’m just going to push back slightly—not because I disagree that the United States is, metaphorically, stabbing itself in the lower intestine over and over again. I’m just not entirely sure why it keeps doing it.

[RM]: You’re Canadian—just so people know, in case they don’t. You have every right to say whatever you like about the United States at this point. I’m not here to challenge any of it.

[MB]: Let me give you an example. Everyone in the West is talking about how bad the transformer backlog is—but that’s a Western problem. It’s not an issue in Asia, and certainly not in China. The United States only manufactures about 20% of its transformers and imports the other 80%, much of it from countries it has now slapped with tariffs—including China, its largest supplier. The U.S. just hit Chinese transformers with a 125% tariff. Meanwhile, the article I shared before we got on the call made the point that Europe, unlike the U.S., doesn’t have this strange phobia about China. They’re realizing China may not be the enemy and are free to buy those transformers to speed up their electrification efforts. Historically, the U.S. has been a wealthy market and a source of innovation—but it’s now making itself harder to do business with.

We’re going to lose access to global markets because the U.S. economy is headed for serious trouble due to recent policy choices. On top of that, the tariffs make it an unattractive market to sell into. So not only will there be less buying power, but higher barriers to trade—for at least the next couple of years, until hopefully some sanity returns. Meanwhile, the rest of the world is simply trading around the U.S. Europe has just signed two more free trade agreements and remains the largest trading bloc in the world. And Americans often don’t realize that the U.S. accounts for only 13.3% of China’s exports by purchasing power parity.

Now that the rest of the world can’t export to or import from the U.S. the way they used to—because of tariffs—they’re going to turn to China instead. So China will do just fine, and so will much of the rest of the world. But China hasn’t bought into the hydrogen delusion the way the West has. The transformer shortage is a Western problem. The idea of hydrogen as a major energy carrier is largely a Western—and Western-aligned—narrative. China is far more focused on direct electrification, grid integration, and batteries. Their investment in hydrogen fuel cells is minimal—a small side bet compared to their core strategy.

[RM]: Absolutely. I think when people look at China, they often see big numbers and assume they’re meaningful in a global context. I was giving a talk on small modular reactors recently and pointed out that China is the only country currently building a substantial amount of nuclear—around 35 gigawatts over the next six years. But they also built 350 gigawatts of wind and solar just last year. So yes, people point to China and say, “Look, they can build nuclear, why can’t we?”—and you’ve written some great pieces on that. But the reality is, nuclear is just a tiny fraction of what China is doing. It’s clearly not where they see the future. As you’ve noted, they’ve missed their nuclear targets but surpassed their goals for solar, wind, and batteries.

Yes, it’s easy to point at China and say, “Look how much they’re doing.” Even a relatively small effort from them looks massive compared to us. There’s no question about that. We know what the solutions are, but in the U.S., we face real obstacles—especially with transformers and the broader challenges of building out power and distribution infrastructure. We also have a political system that makes this harder, even though there’s actually bipartisan support for some of these initiatives. And now, with the new tariffs, things are even more complicated. Add to that the issue of rare earth metals, where China dominates. Our president seems stuck in a 1990s mindset, thinking the U.S. still holds all the leverage. Sure, we’re a big market—but we’re not as big as China.

If you force countries at gunpoint to choose between betting their future on the U.S. or China, it’s a tough call. I think people in this country are confused, partly because so much of what we export is cultural—movies, for example. When we talk about the trade deficit, it’s usually framed around manufacturing. Yes, we import a lot more manufactured goods, but we also export a significant amount of services. And honestly, I’m not even sure a movie counts as a service—it’s somewhere in between. The point is, we have a lot to lose, and we’re about to find out just how much. And let’s not forget, Canada was our best friend in the world—and now we’re not even visiting.

There was a study that just came out showing we could lose 0.3% of GDP from tourism losses alone. I don’t want to dwell on that, but the bigger picture is clear—we haven’t just shot ourselves in the foot; we’re using a machine gun and firing the same bullet into the same spot every day. This is going to hurt the clean energy industry. Yes, we do have a solid domestic sector, but having 100%+ trade tariffs on both sides just isn’t tenable.

[MB]: I’ll just say this—your domestic manufacturing of wind, solar, and other clean technologies is going to take a hit with 25% tariffs on aluminum and batteries, and even steeper ones on steel. Especially considering that 50% of your aluminum comes from your so-called good buddy, Canada. The minerals geopolitics of the Trump administration is… well, let’s just say I’m thinking of plenty of colorful metaphors, but I’ll leave it to the audience to fill those in.

[RM]: Well, look—yeah, let’s remember that over 90% of our uranium comes from Canada. Canada is the world’s largest supplier. What many people don’t realize is that Canada now owns Westinghouse. So effectively, Canada owns the only major Western nuclear reactor vendor.

[MB]: Brookfield has now moved its headquarters to New York—a fact that’s come up as an issue in our current prime ministerial election, since Carney was on the board of Westinghouse. So our current prime minister, and likely the next one according to all the polling, was on the board of a company that’s now part of Brookfield International. Born in Canada, an amazing corporation—but yes, it’s now headquartered in New York. [sic—Brookfield’s investment arm is now headquartered in New York and Carney was on the Board of the investment arm. Brookfield overall is still based in Canada.]

[RM]: Yeah, exactly. The nuclear industry is uniquely interconnected—it relies on materials like yttrium. I was telling someone the other day, they asked me what it was, and I said, “Don’t worry, you’re going to learn what yttrium is soon enough.”

[MB]: People are learning how to spell yttrium.

[RM]: Y-T-T-R-I-U-M. I looked it up in the Department of Energy’s Advanced Nuclear Liftoff report, specifically the second commercialization report released in September. They list critical materials, and yttrium is on that list.

[MB]: Well, I’m betting HALEU you is as well.

[RM]: There are a lot of names and terms people are going to have to learn. One of the key things people often misunderstand is that China doesn’t just mine critical minerals—they’ve been smart enough to dominate the refining side as well. So if you need tungsten, for example, you have to go to China. Tungsten is essential for both fusion and chip manufacturing. I’d say we’re heading toward a period of resource rationing, whether we like it or not.

[MB]: Normally, a politician—especially a prime minister—would place all their assets and business interests into a blind trust, though they’d still know that tanking the economy would hurt their own holdings. But in the case of the Trump family, I’d say there’s a 100% chance they’re shorting key stocks based on insider knowledge through shell companies. That said, let’s bring the focus back.

[RM]: I think it’s all relevant—these speculative technologies become much harder to scale in a world without free trade. These industries were built on the assumption that they could source rare metals and components from wherever they were cheapest. But the other end of the equation is just as important: selling the product. Take small modular reactors, for example. The plan was to sell them to Europe and Canada. But without access to those export markets, and without mass production, the costs will never come down.

The point is, you need customers who actually want to buy your product. If your company becomes a kind of global villain, people start asking why they’d take a risk on a speculative technology—especially something like hydrogen. If I’m buying a new technology from you, I need to be confident you’ll still be around in five or ten years in case something goes wrong. This isn’t like buying a light bulb, where the technology is proven and the risk is minimal. Emerging, speculative technologies are going to face a much tougher road.

[MB]: Yes, I definitely highlight that as a strategic risk. I’ve pointed it out to transit agencies buying hydrogen buses. There are two key examples I often cite. First, Van Hool in the Netherlands, which made several strategic missteps—including a focus on hydrogen buses—and ended up going bankrupt. Second, Quantron in Germany, a truck manufacturer that offered both battery-electric and hydrogen trucks. Their lack of strategic focus resulted in overpriced, underperforming battery-electric models and unreliable, customer-unfriendly hydrogen vehicles. They too went bankrupt. As a result, companies like IKEA in Austria are now stuck with a mixed fleet of Quantron hydrogen and battery-electric trucks with no support, no maintenance, and no warranty.

The premise is clear—and now Nikola has finally gone bankrupt as well. They made the same mistake: trying to push both battery-electric and hydrogen vehicles instead of focusing on the obvious winner. Any manufacturer splitting its focus is creating unnecessary risk for its vendors and customers. Organizations around the world should be paying attention. Battery-electric is the clear winner, and if your supplier is also investing in hydrogen vehicles, they’re putting your future warranty and maintenance support at risk. By the way, did you see the recent announcement from the German and French economic advisors?

[RM]: I thought you wrote about that.

[MB]: I did, but I never assume anyone actually reads what I write.

[RM]: Some of that came through, but if you’d like to go into it a bit more, I’d love to hear it.

[MB]: Sure. Essentially, the senior economic advisors to the German and French governments—the two largest economies in Europe and the most powerful voices in the EU, despite what Belgium might say—looked at the data and issued a joint statement on road freight. They made six key points, all of which amounted to this: hydrogen is dead for trucks, battery-electric wins. They recommended building out megawatt-scale charging infrastructure everywhere, avoiding bad investments, and focusing entirely on batteries and charging. They also called for opening up fuel regulations, eliminating mandates for synthetic fuels and hydrogen, and scrapping the requirement for hydrogen refueling stations every 150 kilometers. In other words, France and Germany’s top economic advisors are signaling that their countries won’t be funding hydrogen trucking infrastructure.

This is part of the Latourian narrative collapsing, as major actors—using Latour’s term—begin to disarticulate from it.

[RM]: Right—and take Airbus and the broader European aviation industry as an example. You might remember the post I did on LinkedIn about BlackRock launching an exchange-traded fund that combines energy storage and hydrogen. This is supposed to be a sophisticated firm, yet it’s bundling a clear winner with a likely loser. As you said, it’s very similar to the kind of structural lock-in described by Kuhn. I actually took a class on that at MIT—he was there when I was working on tech transfer. There’s absolutely a paradigm at play. Once people buy into it—call it a worldview—they stop seeing the flaws. It’s like falling in love: everything about the person seems good, and even the faults either go unnoticed or get rationalized away.

One of the points I make in the book is that no investments today should be made on the assumption that hydrogen is the ultimate winner. The debate in both the U.S. and Europe over truly green hydrogen—meaning hourly-matched, locally sourced, new renewable energy—was resisted by the industry. They argued that such strict standards would slow hydrogen development. Instead, they pushed for permission to start with dirty hydrogen, promising to switch to clean production by 2030. But as I say in the book, that entire approach is based on the assumption that hydrogen will eventually win. It implies that anything you do now, even if it’s not ideal, is still a good long-term decision.

But the point is that hydrogen may be good for very little. All you’re doing is creating a lot of capital that could end up stranded. Everyone loses their money, and on top of that, you’re polluting. If you’re running off the grid, you’re effectively saying, “Please let us call grid power electrolysis green because we’ll buy some renewable energy credits or use some other fig leaf.” But obviously, that’s even dirtier.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy