Ahead of the Federal Reserve FOMC meeting today, economists expect interest rates to remain unchanged between the 4.25% and 4.5% range. What will be the FOMC Bitcoin impact? Will BTCUSDT break $110,000?

Bitcoin, Solana, and some of the best cryptos to buy in the top 20 are trading inside tight ranges. BTC ‚Ėľ-1.85% is down, capped below $105,500, while ETH ‚Ėľ-1.51% is yet to break above $3,000. Meanwhile, is struggling to close above $170, down 11% in 24 hours, making it one of the top losers in the top 10, trailing .

Clearly, the crypto market and its participants are proceeding cautiously. Ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting in the United States, Bitcoin traders are focused on one key question: Will today’s Federal Reserve decision shift the tide for crypto assets, triggering a wave of demand that lifts prices above critical liquidation levels?

This question is relevant: Inflation, tariffs, and an unusually shaky macroeconomic backdrop, worsened by conflict in the Middle East, dominate headlines, requiring the central bank to move with tact.

DISCOVER:¬†9 Best Crypto Presales to Invest in June 2025 ‚Äď Top Token Presales

The FOMC Dilemma: Will It Hold or Cut Rates?

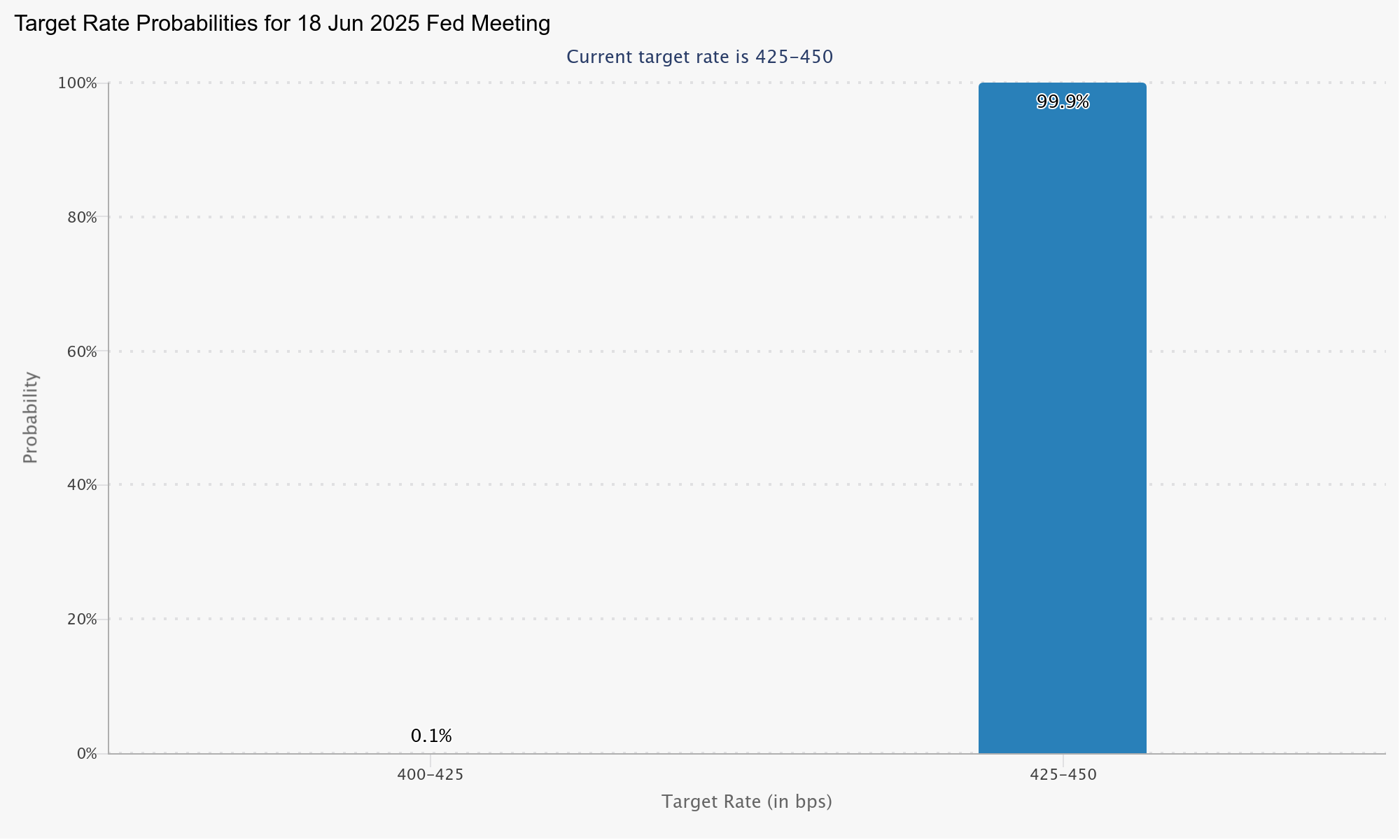

Most economists and analysts expect rates to remain unchanged between 4.25% and 4.5%.

According to the CME FedWatch tool, the probability of the central bank holding rates steady is a staggering 99.9%.

(Source)

Although the consensus is for rates to remain unchanged, Bitcoin traders will closely monitor what the Federal Reserve Chair, Jerome Powell, says during the press conference.

This is because, while interest rates are the focus, the central bank’s thoughts and forward guidance are equally critical.

As in the May 7 press conference, little change is expected.

Powell will likely adopt a data-dependent stance, especially given President Trump’s aggressive tariff agenda and mixed economic data, particularly on inflation.

Moreover, the Federal Reserve is navigating a delicate balancing act between keeping rates low, around the benchmark 2%, while ensuring economic growth despite rising debt levels.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Impact of FOMC on Bitcoin

As seen during the 2021 crypto boom, crypto and Bitcoin prices thrive during periods of low interest rates.

When the central bank eases monetary policy, more money circulates, some of which is invested in Bitcoin and other ‚Äúrisky‚ÄĚ crypto assets, including some of the best Solana meme coins.

During such times, inflation also tends to rise.

However, unlike 2021, the macroeconomic environment in 2025 is different.

The global economy is grappling with tariff wars, labor market uncertainty, and stagflation due to persistent inflation and slow economic growth.

Although core inflation slowed in May 2025, it remains elevated, and tariffs could reignite price pressures, especially if no deal is reached with the European Union and China.

For this reason, if the Federal Reserve unexpectedly slashes rates against economists’ forecasts, the Bitcoin price could spike. There is a chance that it may break above $110,000 by the end of the week.

Still, even if rates are cut, the timing could be problematic. This view is considering the inflationary risks posed by tariffs and a slowing economy.

Consequently, a surprise rate cut could trigger capital flight to the USD and treasuries. Subsequently, there could be an unexpected sell-offs in cryptos as the greenback strengthens.

DISCOVER: 7 High-Risk High-Reward Cryptos for 2025

Will Federal Reserve Rates Hold? FOMC Bitcoin Impact

- Crypto traders closely monitoring the FOMC rate decision

- Will the Federal Reserve keep rates unchanged?

- Macro environment mixed as inflation and labor markets in focus

- Will Bitcoin rip higher or dump?

The post Crypto Traders Watching Federal Reserve: What Will Be The FOMC Bitcoin Impact? appeared first on 99Bitcoins.