Last Updated on: 28th May 2025, 12:00 am

The transition to EVs in Europe: a two-speed dynamic

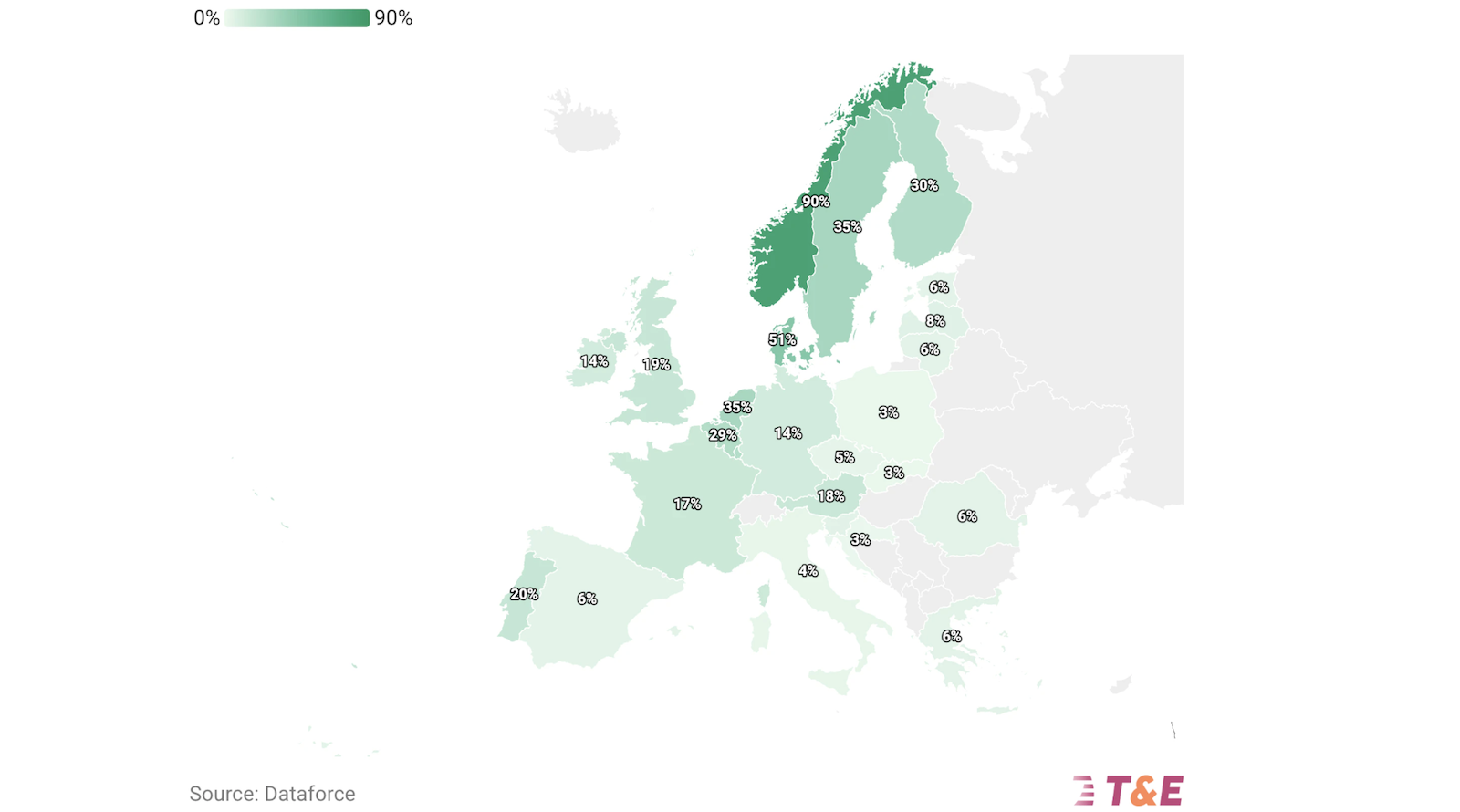

The transition to EVs in Europe is a heterogeneous process. Both between and within countries, this change highlights varying capacities to adapt, and inequalities in access to a sustainable mobility.

The EV uptake is slower in Southern and Eastern countries. The electrification of the European car fleet is still in its infancy, with mass market uptake accelerating from 2025. While France and Germany are amongst the leaders, with EVs accounting for 17% and 14% respectively of new vehicle sales in 2024, the other three countries covered by this report – Italy, Spain and Poland – are still lagging behind, with EVs accounting for 4%, 6% and 3% respectively of new vehicle sales that same year.

A rapid transition to EVs in the selected Member States is hindered by the high purchasing price of EVs as explained in the next sub-section, which leads to passenger cars typically remaining in the national fleet for 10 to 15 years and having long average lifespans, ranging from 15 to 20 years in Germany, France, Spain, and Italy, to 35 years in Poland. In Spain, 47 % of the car park is “more than 15 years old” (Dirección General de Tráfico – DGT, 2023). The high figure in Poland can be explained by the large proportion of imported second-hand cars (738,439 imported vehicles compared to 475,032 new registrations in 2023), which dominate the car fleet. This is further compounded by the presence of a substantial number of unused vehicles in the fleet, estimated at over 7 million, with an average age of 37 years. The development of the Polish car fleet and its gradual electrification depend largely on the influx of imported vehicles, most of which are second-hand and over four years old. As a result, Poland has a low EV share of its total passenger car fleet (0.9%).

The transition to EVs: how premium cars leave the middle and lower classes behind

Electric vehicles are making progress but remain expensive for the middle class. Sales of electric vehicles have grown significantly in the European market since 2020 but have not yet reached mass-market levels. Until now, most EVs sold have been expensive, high-end models purchased by businesses and high-income groups. In Germany, the last purchase bonus – which ended in 2023 – mainly benefited the wealthier sections of the population. Analysis shows that fewer than one in five recipients had a net household income of less than €3,200 per month.

The lack of availability of affordable new EV models (under €25,000) means that EVs remain largely unaffordable for the middle class (the average price of an EV sold in Europe is around €40,000-45,000). As a result, the electric vehicle subsidies introduced in several countries have mainly benefited businesses and high-income groups, failing to meet the needs of low- and middle-income groups. This unequal access to EVs means that these groups do not benefit as much from the lower running costs of EVs and are more vulnerable to fluctuations in fuel prices.

By 2025, the EV market is expected to grow as carmakers launch new affordable EV models to meet the target of reducing CO2Â emissions from cars. However, the vast majority of middle-income drivers purchase their cars from the second-hand market, where EVs are still rare.

Moreover, company fleets play an important role, as cars typically remain in the fleet for 3 to 4 years before reaching the second-hand market. However, corporate fleets are currently lagging behind when it comes to electrification, which limits the availability of second-hand EVs. In 2023 for instance, their electrification rate was still lower than the private households’ rate (14.1% and 15.6% respectively).

The Öko-Institut’s analysis shows that the current automotive market is not equipped to support a mass shift to electric vehicles. In a scenario where current trends continue—regarding prices, available models, and purchasing power—a majority of households in the countries studied will be unable to afford a transition to electric by 2035 (see Figure Annex 2). As a result, they will remain trapped in fossil fuel dependency. The main reasons are insufficient financial means and a lack of available second-hand electric vehicles.

The arrival of new affordable urban EVs—such as the Renault 5, the electric C3, the Panda, and the R4 —marks a step toward market expansion. However, the pace of change remains too slow. Accelerating industrial rollout and implementing complementary social support measures will be essential to ensure no households are left behind.

Read the rest of this briefing on T&E website.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy