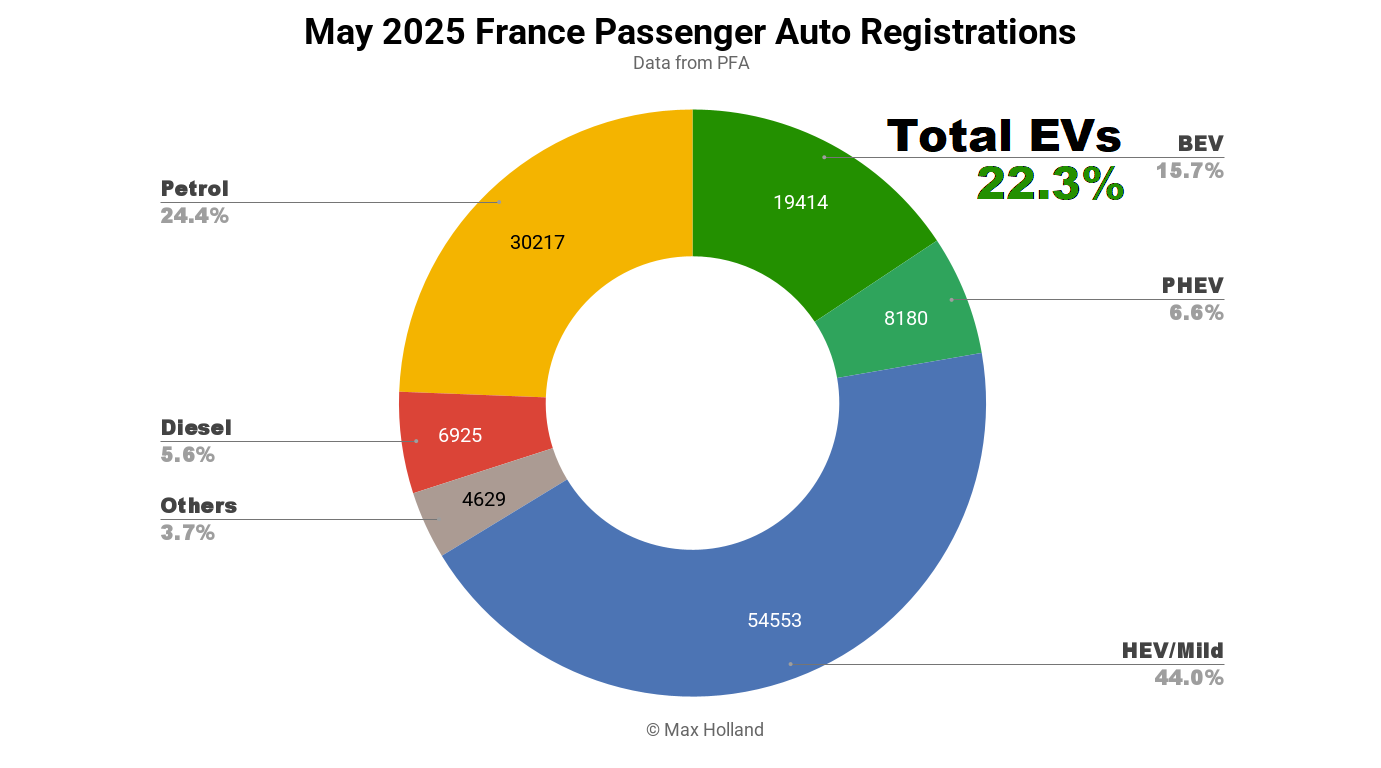

May’s auto sales saw plugin EVs take 22.3% share in France, a drop from 24.1% year-on-year. The YoY baseline was lifted by 2024’s social leasing programme, so the YoY comparison is somewhat skewed. Overall auto volume was 123,919 units, down some 12% YoY. The Citroën e-C3 was the best-selling BEV in May.

May’s auto sales totals saw combined plugin EVs take 22.3% share in France, with 15.7% full battery-electrics (BEVs) and 6.6% plugin hybrids (PHEVs). These compare with YoY figures of 24.1% combined, 16.9% BEV, and 7.2% PHEV.

Although the year-on-year comparison continues to make 2025’s progress appear lacklustre, and the EU commission’s recent folding on the prior 2025 emissions targets is not helping, there are still some bright spots for BEV adoption. Tesla’s new Model Y has delayed volume deliveries until June, due to the entry variants still not yet being approved for France’s 2025 Eco-bonus eligibility (the Volvo EX30 and Hyundai Inster are also not yet approved). The approval is still expected (perhaps within the next week or so) and, given the Model Y’s recent popularity, should thereafter give a boost to summed BEV volumes.

Perhaps more significantly for the long-run, BYD registered a decent number (414 units) of the new Dolphin Surf model (aka the Dolphin Mini, or Seagull in other markets), for showrooms and test drives. Given that this is a small yet competent BEV which will start at under €20,000, and given that unit volumes should be relatively unconstrained, in time the Dolphin Surf should give a strong boost to BEV volumes at the affordable end of the market. This has historically been a particularly important market segment in France, with the recent success of the Renault 5 and Citroën e-C3 only reinforcing the trend. More competition typically brings better value, and ultimately greater volume.

Although plugins are not currently on a particularly impressive trajectory in France, at least HEVs and mild-hybrids continue to replace sales of combustion-only vehicles, speeding the latter’s decline. Petrol-only sales lost 30% of volume YoY, and were down to 24.4% market share. Diesel-only sales lost an even greater 40% of volume, with market share of 5.6%.

Best-Selling BEV Models

Still duelling at the top of the charts, the Citroën e-C3 and Renault 5 swapped places in May, with the e-C3 coming out slightly ahead, with both around 1,500 units. Further back, the Renault Scenic took third, with 1,036 units.

The new Citroën e-C3 Aircross made great progress over the course of a single month, climbing to an impressive 4th position (and 920 units) in May, a huge gain from its 16th spot (495 units) in April.

Not far behind, the new Skoda Elroq continued to climb, from 13th to 6th, with volume up from 519 to 683 units. This is a great result for the new Skoda, and seems to consolidate its overshadowing of the older Enyaq, at least in sales volume.

As mentioned earlier, the important new BYD Dolphin Surf hit showrooms in volume in May, with 414 units registered. Some of these may eventually be sold on to customers, but this volume sent to showrooms suggests that BYD expects a bright future for the Surf after its commercial launch in the coming months. The entry model (30.0 kWh usable) starts just under €20,000, though with a modest WLTP range of 220 km (similar to the Dacia Spring). The larger battery (43.2 kWh usable), with 310 km WLTP, will likely still be priced well under €25,000 in France.

Another new face in May was the Renault 4, the slightly bigger sibling of the Renault 5, with the same underpinnings. It is higher priced though, starting at just under €30,000 for the entry version (vs. €22,000 for the entry 5). Like its sibling, the Renault 4 has already had stellar reviews, so let’s see how it gets on.

Despite patchy data, I’ve put together a short trailing-quarter leader’s chart:

Although the Citroën e-C3 took the monthly title in May, over the longer period, the Renault 5 is currently dominant, with close to twice the Citroën’s sales. However, we remain relatively early in the life of both vehicles, with expanding market entry into new countries still underway, and both are likely still far from reaching a steady-state of production or sales volume.

We can expect to see the Citroën e-C3 Aircross join the top 10 in the next couple of months, and the Renault 4 perhaps by the end of Q3 or early Q4. Further out, it’s likely that the BYD Dolphin Surf will also challenge for the top 10 by the end of this year.

Â

Outlook

The dip in May’s auto market volumes is in tune with the recent slowdown in France’s overall economy. The latest macroeconomic data showed lacklustre YoY output in Q1 2025, with just 0.6% growth, the lowest growth level since 2020, and down from the 0.8% of 2024 Q4.

Headline inflation stood at 0.7% in May, with ECB interest rates at 2.4%. Manufacturing PMI rose to 49.8 points in May, from 48.7 points in April.

Nevertheless, with more simple and affordable BEV models now taking centre stage, and more coming all the time, I feel that momentum continues to build for BEVs overall, in France, across Europe, and beyond. What are your predictions for France’s transition for the remainder of this year? Which are the models to watch out for? Please share your perspective and thoughts in the comment section below.

Â

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy