Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

Last Updated on: 13th May 2025, 10:01 am

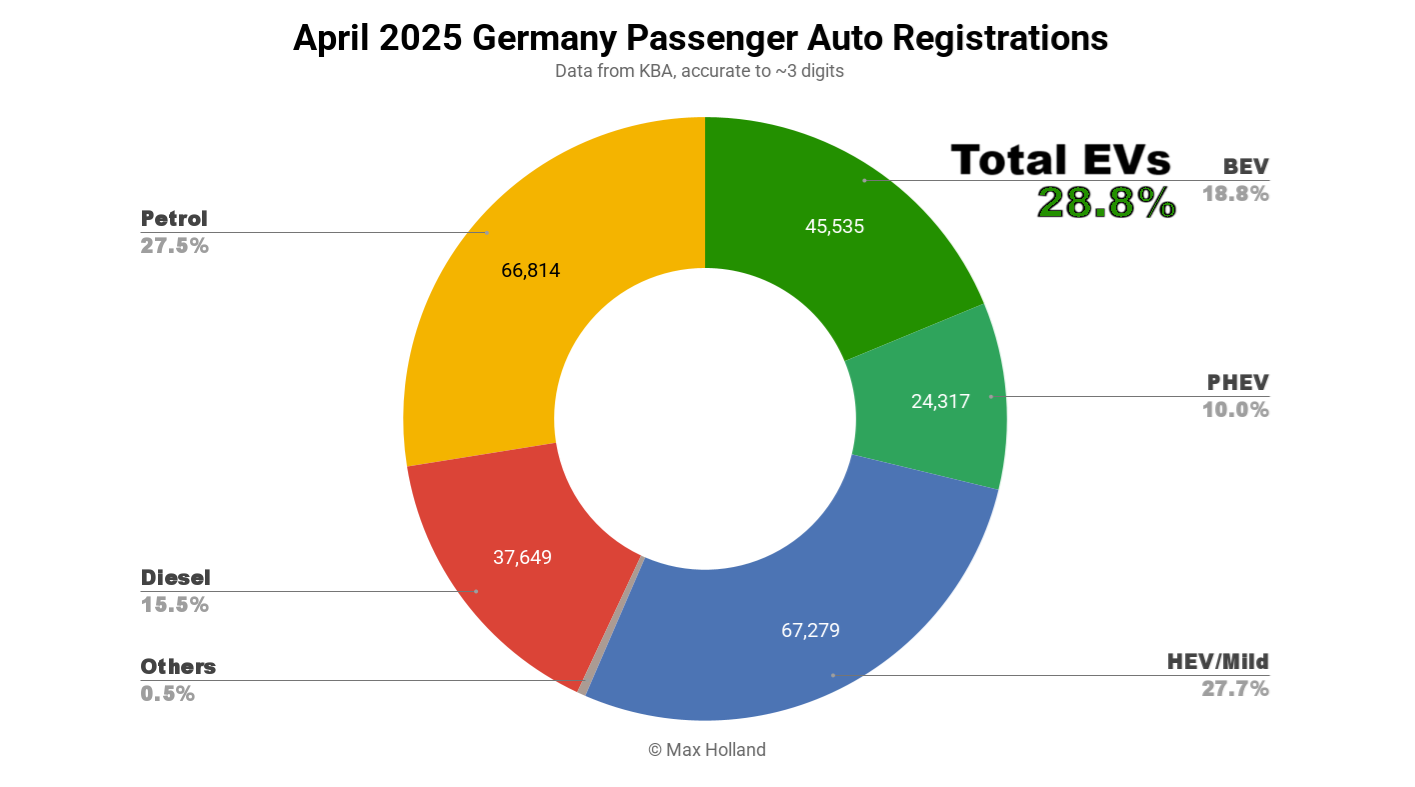

April saw plugin EVs take 28.8% share in Germany, up from 18.4% year on year. BEVs volumes have recovered from their incentive-cut trauma, and PHEVs are also up. Overall auto volume was 242,728 units, flat YoY. The best-selling BEV in April remained the Volkswagen ID.7.

The April auto market saw combined EVs take 28.8% share in Germany, with full electric vehicles (BEVs) at 18.8% share and plugin hybrids (PHEVs) at 10.0%. These compare with YoY figures of 18.4% combined, 12.2% BEV and 6.2% PHEV.

This is a good result for BEVs, moving ahead of France on market share, which is a surprise considering that Germany no longer has any BEV purchase incentives (whilst France still does). We will have to see whether this progress can be sustained over the longer term. I doubt it, since most of the legacy auto manufacturers are still only making as few BEVs as rules require them to. And the EU-zone emissions rules have just been watered down.

As I keep banging on about, we may also be reaching a point where momentum is building on the demand side for affordable (and competent) BEVs which consumers have seen in the wild and now know are possible. Initially these more mass-market BEVs were offered in order to meet the original (tight) 2025 emissions regulations. Even though those regulations have recently been softened, the manufacturers have shown their hand to consumers, and there’s no going back.

I have in mind the recent advent of affordable-and-competent sub-€25,000 BEVs (Renault 5, Citroen e-C3, Fiat Panda, Hyundai Inster, LeapMotor T03, and the BYD Dolphin Surf coming soon) and even more options sub-€30,000 (Opel Frontera, Renault 4, Citroen e-C3 Aircross, Opel Corsa, Fiat 500, BYD Dolphin), and plenty of compelling options in the low €30K range (Skoda Elroq, MG4, BYD Atto 2, etc.).

That these affordable BEVs have “been seen in the wild” means that — even if some legacy automakers were to try to limit their production volumes — many consumers who have been waiting to get into a BEV will anyway just wait patiently and meanwhile not buy an ICE vehicle instead. And the likes of Hyundai and BYD are not going to play along with the laggards by slow-walking their own affordable models.

Put simply (if my take on this is correct), real competition for value BEV offerings is now starting to shape the market, and the foot-draggers may no longer be able to constrain the pace of the EV transition. Perhaps this is wishful thinking, but let’s keep an eye on it (several of the models mentioned above are now in the top 20 rankings, with more coming).

In April, combustion-only share continued to slide to near-record lows, with petrol-only hitting 27.5% share and diesel-only at 15.5%.

Best Selling BEV Models

For the fourth consecutive month, the Volkswagen ID.7 was the best selling BEV in Germany, with 3,133 units registered. The ID.3 came in second place, with 2,989 units (its best volume in 10 months), and the Volkswagen ID.4/ID.5 came third, with 2,629 units.

Remarkably, the top 10 was almost a white-wash for Volkswagen Group, with only the BMW iX1 (in 7th spot) spoiling the party.

Altogether, Volkswagen Group models made 21,300 sales, over 47% share of the passenger BEV market. If we add in the Ford Explorer and Capri, which are both based on Volkswagen Group’s MEB platform, that share increases to 49.7%.

The most significant climber in April was the new Skoda Elroq, which took a remarkable 4th spot in only its fourth month of volume deliveries, up from 9th spot in March. Further back, the Fiat 500 climbed 12 ranks to 11th place, with its highest volume in 9 months (1,045 units).

The new Hyundai Inster, also in only its fourth month of volume deliveries, climbed to 12th spot (1,043 units), from 18th in March. Further back in 18th and 19th spots, the Opel Corsa and MG4 (respectively) saw their best performances in several months, each with over 2Ă— their recent average volumes.

Just outside the top 20, the Renault 5 took a slight dip to 686 units (from its high of 1,070 in March). Though, this is likely due to allocation priorities (of limited available volumes), rather than any significant dip in demand. Its competitor, the Citroen e-C3, saw slowly growing volume, with 394 units in April (from 370 in March).

In terms of other newish models which continued to climb; the Opel Frontera, which quietly launched in late 2024 with only a few units, saw its first big volume month, with 321 registrations in April (ranking 35th). Its cousin, the Fiat Panda, also saw its first significant volumes, 147 units. The BYD Atto 2 also saw its first proper volumes, 262 units in April (having previously seen only “sample” volumes since first appearing in January).

There were two debutants in April. Most impressive in volume terms was an immediate 321 units for the new Ford Puma EV, a BEV version of the existing (and wildly popular) ICE Puma, a small (4,214 mm) crossover. The Puma EV currently has an MSRP from €36,900, but better deals can be found, and I expect that more affordable trims may be offered once the shiny-new vibe cools off a bit.

To compete in the long term, it may have to start below €30K, which should be possible given that the battery is a modest 43.6 kWh (usable). Note that despite the modest battery, efficiency is decent, giving a range of 347 km (WLTP) and charging is impressive, with 10–80% recoverable in 23 minutes. Pricing-wise, this may be a case of Ford deliberately not making the Puma too competitive, because they are likely not yet interested in producing huge numbers, preferring to drag their feet.

The other April debutant was the new Renault 4, the slightly larger and “SUV” styled sibling of the already very successful Renault 5. The Renault 4 is 4,143 mm in length, compared to the 3,920 mm of the Renault 5 — though, only 63 mm taller and actually 12 mm narrower. Overall this means the frontal area is barely larger, and thus the WLTP range rating is almost the same, at 409 km (for the 52 kWh variant). It also has the same 33-minute 10–80% DC charging speeed.

If I understand the website correctly, the starting MSRP of the Renault 4 in Germany is currently €29,400, which is some €1,500 more than the Renault 5 is currently offered for. Both versions appear to be only offered with the larger 52 kWh (usable) battery in Germany at the moment. Though, the Renault 5’s page mentions that the smaller battery (40 kWh usable) will be offered later.

If and when that happens, later this year, the starting MSRP should drop by around €2,500 for the Renault 5, and presumably by a similar amount for the Renault 4. However, I’ve heard that some markets (e.g., the UK) may only offer the Renault 4 with the larger battery, so we will have to keep an eye on it.

Let’s turn to the 3-month rankings:

After 4 solid months in the monthly pole-position, the Volkswagen ID.7 has a decent lead in the trailing-3 chart. At this point, as with April’s rankings, only the BMW iX1 prevents Volkswagen Group models from making a clean sweep of the top 10. Another BMW, the i4, is in 11th, and 2024’s overall leader, the Tesla Model Y, is in 12th.

The biggest climber was the Skoda Elroq, which had only just arrived in the prior period (November to January) and has sold almost 4,000 units over the past three months, taking 6th place. Based on April’s performance, it still has further to climb.

Another big climber was the Audi A6 e-tron, which had a slow initial few months after its June 2024 debut but hit huge volumes from February onwards, netting 3,244 units (and 10th place) in this latest period.

Further back, strong climbers include the Renault 5 in 17th (from 27th previously), the Hyundai Inster in 19th (from 45th), the Kia EV3 in 20th (from 29th), and the Citroen e-C3 in 34th (from 67th). Even the LeapMotor T03 is climbing since its November launch, now in 39th, from 56th previously.

Let’s see what the table looks like in a month or two from now. Will the Tesla Model Y’s refresh and production ramp allow it to compete near the top again, or are those days gone? Will the Skoda Elroq displace the ID.3? What stable positions will the Renault 5 and Hyundai Inster be able to climb to? Inside the top 15? Inside the top 10?

Manufacturing Groups

In the trailing-3-month group chart we can see that Volkswagen Group is stronger than ever, with 58,060 units, representing 47.4% of the BEV market (up from 44.4% in the prior 3 months).

BMW Group remains in second, though with share dropping to 11.7% (from 14.7% prior).

Thanks to the Inster and the EV3, Hyundai Motor Group has climbed two spots to 3rd, with share growing to 8.1% (from 6.1% prior).

Stellantis has also made a big push recently, across a wide range of older models (though particularly the Fiat 500 and Opel Corsa) as well as the newcomers (Fiat Panda, Opel Frontera, Citroen e-C30, LeapMotor T03). This allowed the group to climb from 7th to 4th, and more than double share to 7.6% (from 3.6%).

Mercedes Group dropped a couple of ranks, as did Tesla, whereas Renault Group and Geely held position.

Outlook

Although April’s auto market was flat YoY, the year-to-date volume is down some 3% over last year. Fortunately, BEV sales are up some 43% YTD — although, from the depressed baseline of early 2024 (the incentive cut trauma).

The broader German economy suffered another quarterly contraction in Q1 2025, with negative 0.2% YoY GDP, which continues the same negative 0.2% in Q4 2024. Inflation fell to 2.1% in April from 2.2% in March, and ECB interest rates reduced to 2.4% in mid April. Manufacturing PMI in April was 48.4 points, barely improved from March’s 48.3 points.

Anyone familiar with Volkswagen Group’s inner workings, please let us know what’s behind this notable push in BEV volumes over the past month or so. Is it a decoupling to avoid “Trump’s Tariffs,” and funneling units into the domestic market that would otherwise have gone to the US? Or perhaps Volkswagen Group has simply decided to get serious about BEV production in Europe?

What about my hypothesis that the recently launched competent-but-affordable BEVs — now that they are out of the bag — will start to give significant momentum to the demand side of the auto market? Will we have to wait for BYD to show up to really see change start to happen? Please share your thoughts and perspectives in the discussion below.

Â

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy