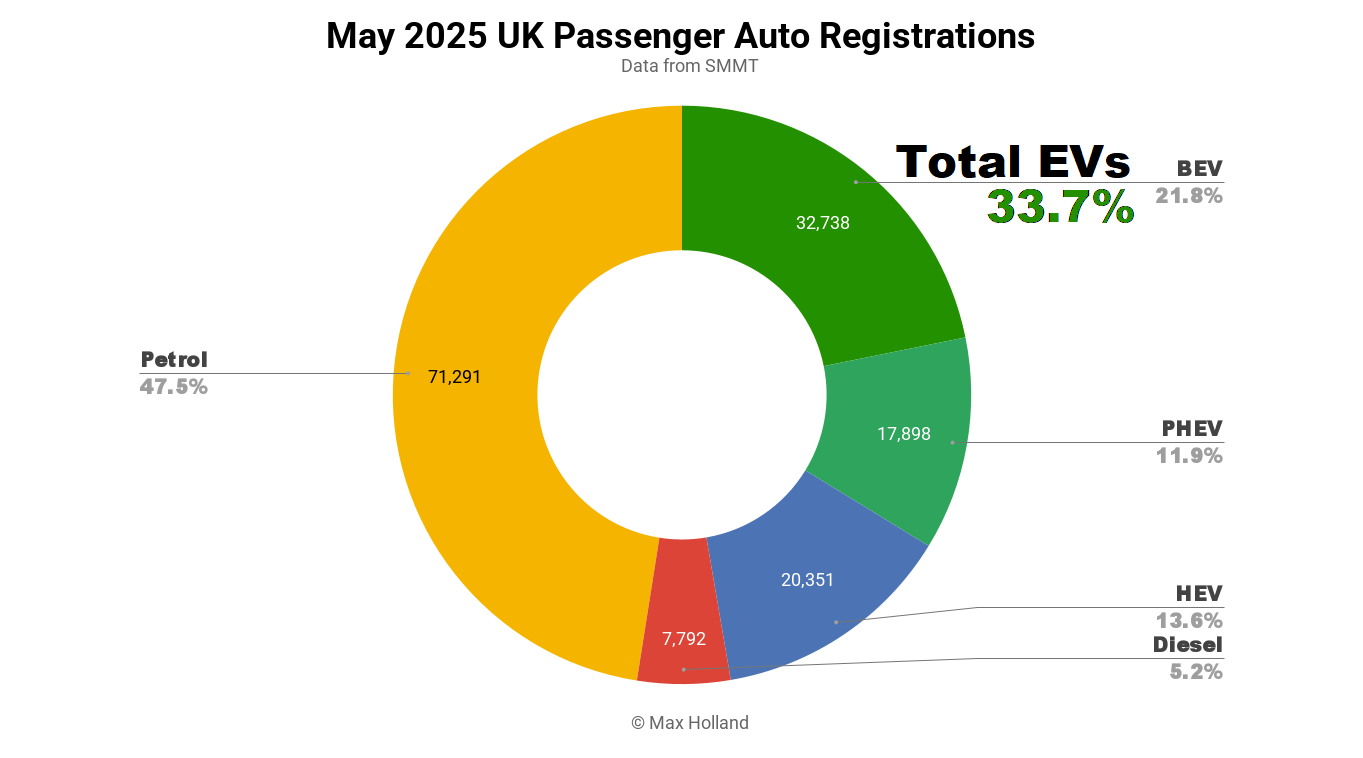

May saw plugin EVs take 33.7% share of the UK auto market, up from 25.7% year-on-year. BEVs grew in volume by 26% YoY, while PHEVs grew 51%. Overall auto volume was fractionally up year-on-year, at 150,070 units. Volkswagen was the UK’s leading BEV brand in May.

May’s sales totals saw combined plugin EVs take 33.7% share of the UK auto market, with full electrics (BEVs) taking 21.8%, and plugin hybrids (PHEVs) taking 11.9%. These compare with YoY shares of 25.7% combined, 17.6% BEV, and 8.0% PHEV.

Both BEVs and PHEVs grew YoY volume at a healthy clip (by 26% and 51% respectively). HEVs grew YoY volume by just over 4%, and combustion-only powertrains lost volume despite the growing overall market. Looking at year-to-date performance, plugins currently stand at a combined 30.9% market share, compared to 23.9% share at this point in 2024. YTD, over two-thirds of UK plugin sales are BEVs.

Meanwhile, petrol-only share has been under 50% for the past four months, and diesel-only share has stayed under 6%. It is possible that combined plugin share may – for the first time – briefly overtake combined combustion-only share in December this year.

Best-Selling BEV Brands

The Volkswagen brand was the leading BEV seller in May, with 11.5% of the passenger BEV market, led by the ID.4 and the ID.7. In second place was BMW with 7.3% share, with the i4 and iX2 the best-selling models.

The Audi brand came in third, with 6.9% of the BEV market, with the Q6 e-tron and Q4 e-tron the most popular models.

Last year’s leader, Tesla, took 4th place in May – an improvement over its slow April (17th spot) – as the new Tesla Model Y started to arrive in moderate numbers. Early figures for June suggest that Model Y units are now arriving much faster, with Tesla’s first-week-of-June market share at over 21% of the UK BEV market. This share will moderate over the entire month, but it’s possible Tesla will return to the top spot, let’s wait and see.

Overall there were no big changes in ranking other than Tesla’s normal monthly variations.

I couldn’t detect any debuts in the (patchy) model data, though some of the recent newcomers are growing and reshaping the market. The most significant so far this year is the new Skoda Elroq, which saw a huge customer debut in March with 959 units (following a few prior test-drive units in January). It has since delivered 713 units in April, and 750 units in May. In short, it has had a very strong reception, and looks to be a success for Skoda in the UK market.

Similarly, the new Ford Puma launched in April with a strong 301 units, and increased to 354 units in May, with room to grow much further. At a smaller scale, but with potential to keep growing, the MG S5 saw a quiet debut in March with 15 units, stepped up to 116 in April, and 122 in May.

Turning now to the small-and-affordable segment; the most affordable — the Dacia Spring — which arrived in October, averaged around 300 monthly units initially and then jumped up to 700 units in March. April and May have seen it back to around 300 monthly units. This is solid, though not spectacular.

In the slightly more expensive (though more competent) segment, the Citroen e-C3 saw 162 units in February, 301 in March, 93 in April, and 123 in May. The Hyundai Inster debuted in April with 204 units, and grew to 228 in May. This class is currently led by the Renault 5, however, which saw 158 units in February, 60 in March, 370 in April, and 510 in May. This was enough to see the Renault 5 scrape into the UK’s top 20 BEV models in May, a great early result for Renault.

However, there’s now a hot new contender in this class – the BYD Dolphin Surf – which registered its first 11 UK units in May. These may only be test-drive unit for now, and customer deliveries will likely come a bit later. The Dolphin Surf was the third best-selling BEV worldwide in April, so the R5, the Inster, and the e-C3 are about to face a formidable new competitor in their segment.

This competition in ever more affordable segments is good news for consumers and should mean that the balance of BEV market segments starts to more closely resemble that of the overall auto market, after years of BEVs being mostly limited to more expensive vehicle categories.

Let’s now turn to the trailing three-month chart:

After two months in pole position, the Volkswagen brand finally overtook Tesla in May’s trailing-3 chart. As mentioned earlier, however, Tesla is on track to have a big June with the new Model Y finally able to deliver in volume, and will likely re-take the brand lead, perhaps for the remainder of the year.

The notable climbers compared to three months prior include Kia, up 4 places to 6th, thanks to the recent popularity of the EV3. Also, Skoda, up 9 places to 8th spot, thanks to the Elroq. Finally, BYD is doing solidly, up 6 places to 9th, thanks not to any individual superstars but instead thanks to the brand’s widening lineup of solid and good-value offerings – including the Atto 3, Seal, Dolphin, and Sealion.

Outlook

The UK’s broader macroeconomy is faring better than many European neighbours, with 2025 Q1 YoY GDP figures showing 1.3% growth, following 1.5% growth in 2024 Q4. Inflation, however, stood at 3.5% in April (latest data), sharply up from 2.6% in March, in part due to energy price increases. Interest rates were lowered to 4.25% in early May, from 4.5% prior. Manufacturing PMI improved to 46.4 points in May, from 45.4 points in April.

Following the ZEV mandate’s success in its first year of 2024, the 2025 mandate is expected to result in an overall BEV share of around 23% to 24% this year. This is lower than the headline “28%” target, because various fudges for PHEVs, HEVs, and “efficient ICEs” are allowed to modify the accounting. This will nevertheless be a faster transition than many European neighbours, which have seen the EU’s 2025 vehicle emissions targets recently watered down.

Which BEV models are you looking out for, or do you think will quickly grow in popularity in the UK? Please share your thoughts and perspectives in the comments below.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy