Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

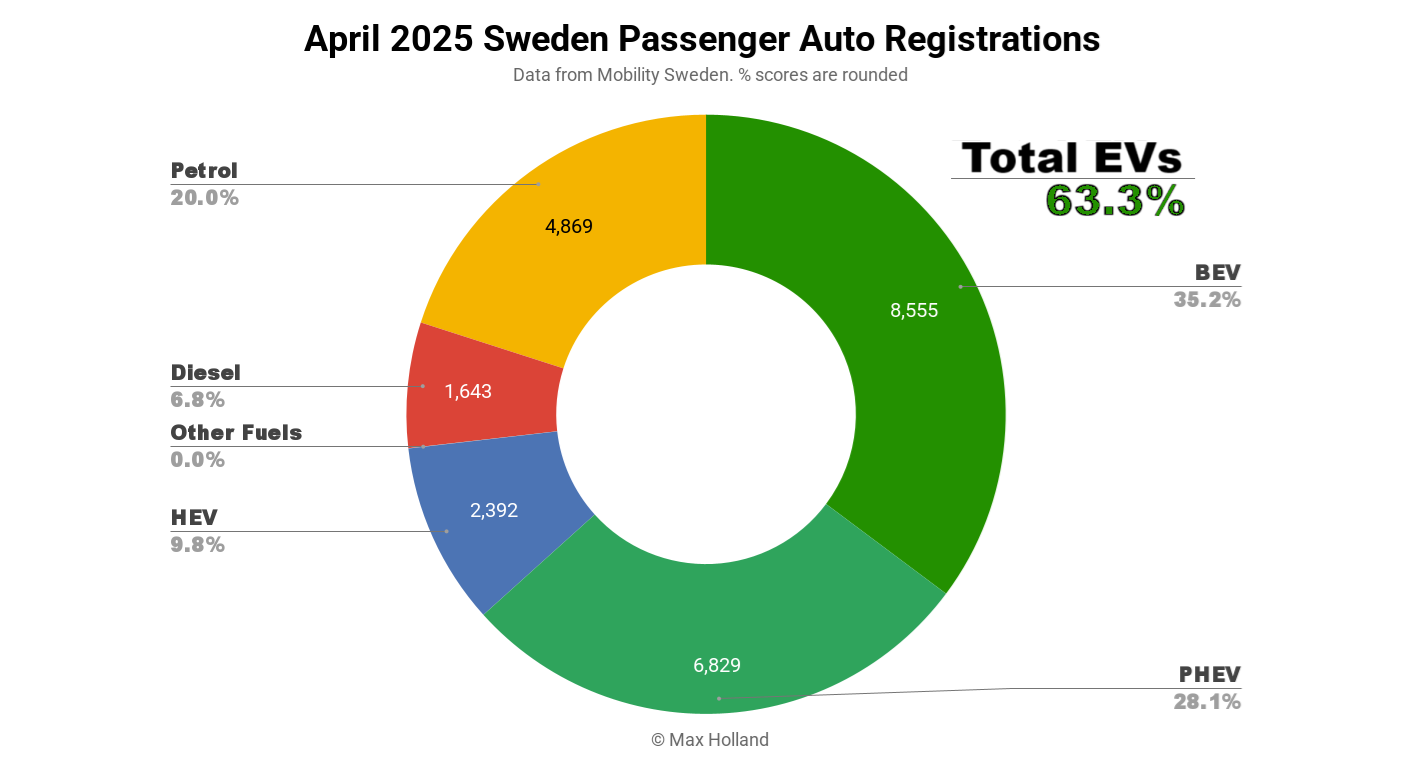

April saw plugin EVs take 63.3% share in Sweden, up from 56.9% YoY. This growth was primarily driven by a rise in BEV volumes, while PHEVs also experienced an increase. Overall auto volume was 24,292 units, up some 11% YoY. The Volkswagen ID.7 was the best-selling BEV in April.

April’s auto sales saw combined plugin EVs take 63.3% share in Sweden, with full battery-electrics (BEVs) at 35.2%, and plugin hybrids (PHEVs) at 28.1%. These shares compare YoY against 56.9% combined, with 30.9% BEV, and 26.0% PHEV.

In terms of sales volumes, both BEVs and PHEVs saw decent YoY growth, of 26% and 20% respectively. HEVs (up 12%) barely matched the overall market’s 11% growth, diesel-only underperformed the market (up just 9%), and petrol-only was down in volume (by 6%). Note also that sales of “other fuels” (mostly ethanol ICE) have now evaporated since their tax reclassification (as effectively petrol cars), back in January. Perhaps unsurprisingly, for now it seems former ethanol-car buyers have migrated to petrol vehicles instead.

The vast majority of plugless HEVs sold over the past 15 months were Toyotas, with around two thirds of all HEV sales. Meanwhile Toyota contributed less than 3% of the PHEVs sold, and far less than 1% of BEVs sold (under a thousand units), over the same period.

Stepping back, the EV transition is still happening pretty slowly in Sweden. Year-to-date plugin share is 59.5% (with 33.6% being BEVs). The 2024 YTD figure was 55.2% (30.9% BEV), and the 2023 YTD figure was 56.3% (35.6% BEV). It’s clear that BEVs alone aren’t growing strongly, and thus PHEVs are bolstering the overall plugin result.

The November 2022 cancellation of BEV incentives has put a significant brake on progress since. By now, however, BEVs should ideally be standing on their own feet and far outcompeting same-segment ICE cars on TCO, reliability, refinement, and other advantages. They are doing this in some segments, but plugless vehicles remain over 40% of the market year to date.

One significant change happening recently (Q4 2024 onwards) is the European arrival of the new generation of competent small-and-relatively-affordable BEVs (Renault 5, Citroen e-C3, Hyundai Inster, Leapmotor T03 in some markets), and with the BYD Dolphin Mini (aka Dolphin Surf), and other models imminent. Relatively affordable here means MSRP starting from under €25k (or ideally under €20k). This segment is already starting to take off in neighbouring Norway, and Sweden will gradually follow suit.

The fact that non-laggards like Leapmotor and BYD (and Hyundai to some extent) are playing in this space should make for strong volumes and competition, and thus increased competence and value over time. This will have knock-on effects in improving the value of adjacent segments, and further improve BEV share.

Best Selling BEV Models

The Volkswagen ID.7 was the best selling BEV in April, taking over from last month’s leader, the Volvo XC40, which dropped to second. Another Volvo, the EX30, took third place.

The Volkswagen ID.7 has been very popular in Sweden (and in Norway), especially since launching the Avant / Touring / Wagon variant in the summer of 2024. It has consistently been in Sweden’s top 5 since September.

While most of the top 20 are familiar faces, there are a couple of notable movers. One is the new Audi A6 e-tron, which saw its highest volumes yet, at 237 units, taking 11th spot (from 17th in March), in just its 4th month of volume sales.

Staying with the Volkswagen Group, another climber was the new Skoda Elroq. The Enyaq’s smaller and more affordable sibling registered 180 units, and entered the table in 15th place, in just its third month on sale. Given that the Enyaq has been consistently popular in Sweden, we can expect the new Elroq to climb further still in the months ahead, and likely become a regular member of the top 10.

Outside the top 20, the new Renault 5 saw its first month of decent volume (likely including some of the first actual customer deliveries), with 96 units registered, taking 26th place. This is actually ahead of the Renault 5’s volumes in neighbouring Norway (where its competitors, discussed below, have started first). As alluded to in the discussion above, could this be the start of the small-and-competent era for BEVs in Sweden? Let’s keep a close eye on it.

Meanwhile, the little Renault’s close competitor, the new Hyundai Inster, is still “in waiting” in Sweden with just 18 units in April, following on from its 37 unit debut in February (it’s already surpassed 70 average monthly units in Norway). It’s a compelling vehicle and will give the Renault 5 some healthy competition.

Where’s the Citroen e-C3? Although it saw its first double digit volumes (32 units) in March, and has just seen a strong 173 units in neighbouring Norway, the e-C3 has still not stepped up in Sweden, with just 16 registrations in April.

Looking at Stellantis’ overall BEV strategy in Sweden – basically “being absent” (only ~260 passenger BEVs sold 2025 YTD across all brands) – don’t hold your breath on the Citroen e-C3 quickly climbing to significant volumes in this particular market. If readers have insights into why Stellantis’s BEVs are almost absent in Sweden (even whilst its ICE vehicles sell in decent volume), but are plentiful in Norway, let us know. Is this all about BEV incentives and margins?

Perhaps if the B segment really takes off in Sweden, Stellantis will push the e-C3. Having said all that, it is possible that the ~10% larger (though still relatively affordable) Citroen e-C3 Aircross might be an even better fit in Sweden (and also in Norway). This one has recently debuted in its home market of France, though not yet in Scandinavia.

There were no new BEVs making a Swedish debut in April.

Here’s the 3-month chart:

The Volkswagen ID.7 and Volvo XC40 have been closely competing over the past four months, with each taking the monthly lead twice. As of the latest measurement, the ID.7 is slightly ahead, but the competition will no doubt continue.

The Tesla Model Y took 3rd, on the strength of decent February and March volumes. The Juniper refresh is starting to arrive, with current delivery wait times of roughly 6 to 10 weeks (June or July). Let’s keep an eye on its delivery ramp over the next few months, and see whether it can regain its former pole position.

Further back, the Kia EV3 took its highest place with 5th (from 6th in last month’s trailing-3), a great result considering its recent November volume debut.

The Audi A6 e-tron has joined the top 20 for the first time, in 17th, a good result, let’s see if it is sustained. On current trajectory, the Skoda Elroq should join the top 20 by the end of Q2.

Outlook

The 11% YoY growth in Sweden’s auto market is decent, though volumes are still far down from 2015-2019 norms. The macroeconomic figures show a slowdown of YoY GDP growth to 1.1% in Q1 2025, down from a Q4 2024 figure of 2.4%. Inflation reduced further to 0.3%, and interest rates remained at 2.25%. Manufacturing PMI again improved slightly to 54.2 points in April, from 53.8 points in March.

As you may have gathered, I’m now mostly interested in seeing change in the affordable end of the market. The majority of the petrol-only vehicles still sold are B and C segment vehicles (VW Golf, Peugeot 2008, Kia Ceed, VW T-Roc, Dacia Sandero, Renault Clio, Kia Picanto, etc), and this is a key area in which BEVs have to get more competitive.

The Kia EV3 and Volvo EX30 have made a decent impact here, but aren’t exactly affordable. The Citroen e-C3 (and the Aircross variant), the Hyundai Inster, the Renault 5, and the upcoming BYD Dolphin Surf (formerly “Mini”), and others, have the potential to displace many more remaining ICE sales.

What are your thoughts on Sweden’s EV transition? Which new models do you think will displace remaining ICE sales most strongly in the year or so ahead? Please join in the discussion in the comments below.

Â

Â

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy