Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

Last Updated on: 9th May 2025, 08:30 am

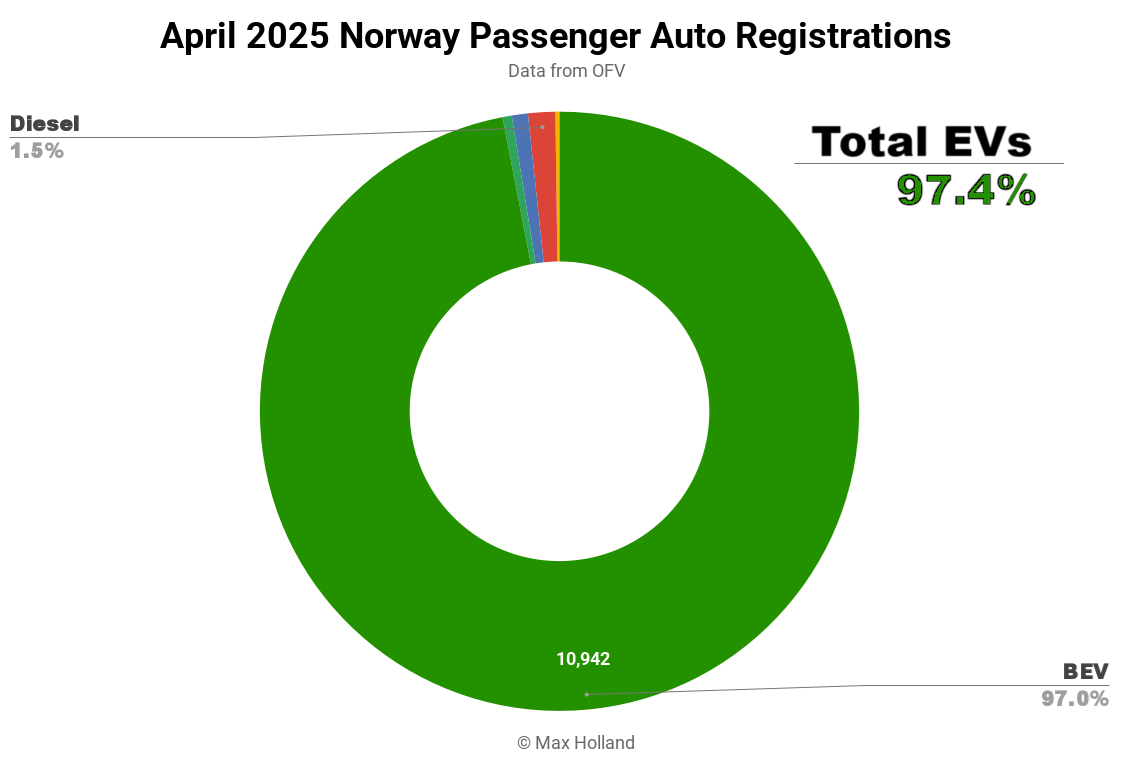

The April auto market saw plugin EVs take 97.4% share in Norway, up from 91.0% year on year. BEVs alone accounted for 97.0% of all new car registrations, with diesels taking half of the remainder (and 3x the number PHEVs). Total new passenger vehicle registrations for the month reached 11,286 units, a slight increase of 0.4% compared to April 2024. The Tesla Model Y was the best selling vehicle.

April’s sales saw combined EVs take 97.4% share in Norway, with 97.0% full battery electrics (BEVs) and 0.5% plugin hybrids (PHEVs). These compare with YoY figures of 91.0% combined, 89.4% BEV and 1.6% PHEV.

This is not quite a record share for combined plugins (that was 97.5% in September 2024), but it is a new record for BEVs, following tax policy changes designed to disincentivize all other powertrains.

Be careful what you wish for, however. Unfortunately the way the policy has been designed – to specifically make PHEVs the headline undesirables, with higher tax additions than all other powertrains – this has led to HEVs (0.9%) and combustion-only vehicles (1.7% combined) together having over 5x the share of PHEVs (0.5%).

The expression “cart before the horse” comes to mind, at least in respect of the residual powertrains. Diesel alone (1.5%) is now half of the residual (non-BEV) sales, and 3x the sales of PHEVs. How does this make sense? We should watch carefully to see if HEVs and diesels will be equally scrutinised going forwards.

Best Sellers

The Tesla Model Y was the best selling vehicle in April, with 866 units, just ahead of the Volkswagen ID. Buzz (811 units), with the VW ID.4 coming in third (700 units).

Volkswagen Group did well to take five out of the top ten, and another three in the top 20. Both the Buzz and the ID.7 saw “personal best” volumes, and the ID.3 and ID.4 saw their best in roughly 12 months. Just outside the chart in 22nd, the new Audi A6 e-tron also scored a personal best (155 units).

Part of the top 20 VW Group showing came from the new Skoda Elroq, which ramped up to serious delivery volumes (231 units) in only its third month on sale, taking 13th place. This is a good result, but it would be even better to see Skoda (and VW Group) release an affordable competitor in the A-B segment (to join the Renault 5, Citroen e-C3, Hyundai Inster etc).

Part of the top 20 VW Group showing came from the new Skoda Elroq, which ramped up to serious delivery volumes (231 units) in only its third month on sale, taking 13th place. This is a good result, but it would be even better to see Skoda (and VW Group) release an affordable competitor in the A-B segment (to join the Renault 5, Citroen e-C3, Hyundai Inster etc).

Another new entry to the top 20 was the new BYD Sealion, (which debuted in November), which saw a personal best of 230 units, and 14th place, in April. The final new entrant to the top 20 was the new Citroen e-C3, which also saw its first serious volumes (173 units) and took 18th.

This decent volume of the 3981 mm Citroen e-C3 suggests a first provisional answer to my question as to whether these relatively affordable new A / B segment cars would be a good fit for the Scandinavian environment. The provisional answer is yes. Given the former success of the Think City, the Mitsubishi I-Miev, and the VW Group triplets (VW Up! and cousins), perhaps this should come as no surprise.

As I mentioned in the Sweden report, the competing Renault 5 has made its first volume push in Sweden, though has not yet made a push in Norway (adding just 4 units in April), but no doubt it will in the coming months.The immanent Citroen e-C3 Aircross, and Renault 4, (which are both slightly bigger and more “crossover” than their pioneering siblings) will likely also do well in these northern markets.

The Hyundai Inster took a breather in April with 48 units (down from its peak of 105 in March), though this is likely just related to global shipping. It will pick up again soon, and we will track its progress.

Xpeng continues to make steady progress, with its two main models, the G6 and the G9, combining for monthly sales over 300 units for the first time (the G6 joined the lineup last summer). The older G9 boxy-SUV (4,891 mm) has continuously improved since its launch in late 2023 and averaged close to 100 monthly sales over the past year or so, with an uptick in April. The newer, slightly smaller, G6 SUV coupe-back SUV (4,753 mm) has already taken the lead in volume, averaging over 150 monthly units recently.

Talking of Chinese brands, Zeekr is also doing well, and debuted a new model in April, the Zeekr 7X, with an initial 4 units registered. The Zeekr 7X is a 4,825 mm long premium SUV with a starting MSRP of 540,000 NOK (€46,100) for the 75 kWh variant (480 km WLTP), and capable of 10-80% charging in around 12 minutes. Larger battery and higher performance variants are also available. Given that its smaller (4,432 mm) Zeekr X sibling has quickly climbed to 70 units in April (following its February volume debut), there’s every reason to keep an eye on Zeekr’s progress with both these models.

There was one other debut in April – the new Ford Puma registered 9 initial units. The Puma already exists in an ICE version, so this is not a dedicated BEV design. It is a small B-segment SUV with 4,214 mm length, starting from 330,000 NOK (€28,200) MSRP for the entry variant, and is currently Ford’s most affordable BEV. This entry version gets a 42.6 kWh battery with 347 km WLTP, capable of 10-80% charging in a decent 23 minutes. Let’s see how it gets on.

Here’s the trailing 3-month chart:

With strong volumes in March (mostly the older version), and again in April (at least some of which are the new Juniper version), the Tesla Model Y maintains its long-term lead in Norway. Obviously Tesla needs to get more diverse and affordable models into production to have a chance to maintain its brand share of the overall market in the long term, especially as competitors are now ahead in affordability, and arguably in value.

Having the best selling single model is all well and good, but having that single model account for almost two thirds of your brand sales is not great in a market which is rapidly diversifying and adding new technology and features. Brand momentum only works when a brand continues to innovate, particularly in value.

The Volkswagen ID.Buzz has stepped up volumes significantly over recent months, although we need more time to see if these are seasonal volumes with the approach of spring temperatures, or whether this new level of higher volume will be sustained. It seems that the 7 seat version started delivering in growing volumes last autumn, and it is likely this variant which is boosting volumes compared to levels seen earlier in its life (the Buzz launched in late 2022). Please jump into the comments if you have insights.

The Volkswagen ID.7 is continuing to prove a popular addition to the ID. family, stable in 6th place over most of the past 6 months.

The Kia EV3 has now climbed to 11th spot, already a good result, let’s see if it has further to go.

As discussed above, the Xpeng G6 is also showing steady demand, and has remained mostly in the top 20 since last Autumn.

The still relatively new BYD Sealion (launched in November) has just entered into the top 20 for the first time – I’ll be interested to see if it can remain over the longer term. Remarkably, it has accounted for more than half BYD’s total volume over the past three months. Given that several other new BEV models are now on the cusp of joining the top 20 (see below), there’s not a high probability the Sealion will regularly feature, but top 30 ranking seems assured.

There are several new-ish models whose potential entry into the top 20 we should keep a look out for as we head into the summer months. Most likely to join are the Skoda Elroq, and Audi A6 e-tron, perhaps as soon as next month. Then there’s the Volvo EX90 which has been steadily growing volume (148 units in April), which might join if it sustains (or improves on) these levels over the next couple of months. Certainly regular appearance in the top 30 seems likely for the big Volvo.

Further out, the Hyundai Inster might join the top 20 fairly soon, but hasn’t hit a consistent monthly volume just yet, likely because it is shipping the long distance over from Korea and arriving irregularly. Finally the Citroen e-C3 should join by June if it can sustain (or grow) the 173 unit monthly volume just seen in April, though it’s still too early to call. A model needs to grab close to 500 units over a 3 month window to have a chance to hit the top 20.

Norway Fleet Update

We now have updated fleet data from Q1 2025. Because of seasonal de/registration of vehicles, and some other factors that need to be estimated, along with some apparent recent methodology changes, calling out very exact figures is a bit dubious. However the trends are clear, with BEVs still steadily rising, even as PHEVs have now plateaued.

The volume of BEVs added to the fleet (i.e. new sales) peaked in 2022, and the rate of fleet transition has slowed since then, although may again get back to strong sales this year.

The most recent 3 months added just over 1% of the overall fleet to the team-BEV, and BEVs have now reached 28.7% of Norway’s existing fleet. Because petrol-only vehicle sales mostly peaked before 2005 (though had a slight resurgence in 2015), their fleet is older overall and typically retiring at the fastest rate. You can see this in the above graph – the yellow petrol segment has been diminishing at the fastest rate over recent years.

Diesel-only powertrains were hot sellers in the 2007-2016 period, and the median example is now 10 to 15 years old. Because of their relative youth, their rate of retirement has been much lower than that of the typical petrol car, as can be seen in their stubbornly sausage-like red section in the above graph. Their retirement rate will start to increase in the next few years as the median approaches 20 years old.

HEVs (at 5.44% of the fleet, blue in the graph) and PHEVs (7.24%, light green) have effectively plateaued now, and will gradually decline over the coming years.

Overall, if auto sales (now effectively all BEVs) can get back close to pre-2020 levels this year, it will mean that the BEV share of the fleet will grow at around 4% this year (perhaps a little over). That fleet growth rate should tick up in the coming few years, mainly due to a slightly elevated rate of petrol and diesel retirements (rather than due to an elevated rate of BEVs being sold). That is, unless compelling BEVs get super affordable (thanks China) and road-fuels become significantly more expensive, neither of which is impossible.

If that were to happen, the BEV fleet would take-over >4% of the overall fleet pie each year, and climb above 50% of the total passenger vehicle fleet perhaps by mid-to-late 2029. Also bear in mind that newer vehicles (now effectively all BEVs) typically get driven a lot more annual km than older vehicles do.

To understand the more complex dynamics of fleets, vehicle age, annual km driven, and the impact on sales of road fuel, see my in-depth analysis of Norway’s fleet transition.

Outlook

Let’s keep an eye on Norway’s vehicle sales volume across 2025. The past couple of years were lacklustre compared to 2022, and thus aren’t speeding the overall fleet transition. There’s a decent chance 2025 might get back to decent auto sales volumes (now effectively all BEVs) now that more and more affordable models are arriving.

I’ve noted many times that erratic quarterly GDP figures are fairly normal for tiny Norway, heavily dependent as it is on fossil fuel export receipts, and subject to fiscal stimulus from the very deep public purse. The latest compiled data is still that from Q4 2024, showing negative -0.3% GDP year-on-year, a big swing from the +3.7% of Q3 2024. The current macro forecast is for only marginal growth over the next one or two quarters.

Interest rates remained flat at 4.5% in April, unchanged since December 2023. Inflation trimmed very slightly to 2.5%. Manufacturing PMI fell steeply to 46.1 points in April, from 50.6 points in March.

As expressed above, I’m looking forward to seeing how the new and fairly affordable smaller BEV models get on in Norway. I’m also interested to see whether tax policy regarding the residual powertrains will turn to tackling diesel and HEV sales, rather than singling out PHEVs for the harshest punishment.

Please let us know your thoughts and perspective on Norway’s EV transition in the comments section below.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy