El Salvador is defiant and continues to accumulate more Bitcoin despite IMF restrictions. Will a BTCUSDT rally to $120,000 and $500,000 vindicate President Nayib Bukele?

El Salvador made history when it became the first country to legitimize Bitcoin, adopting it as an official legal tender. Since endorsing Bitcoin, El Salvador has attracted major corporations, including Tether, the issuer of USDT. The stablecoin plays a key role in crypto, allowing investors to get exposure in some of the hottest presales in 2025.

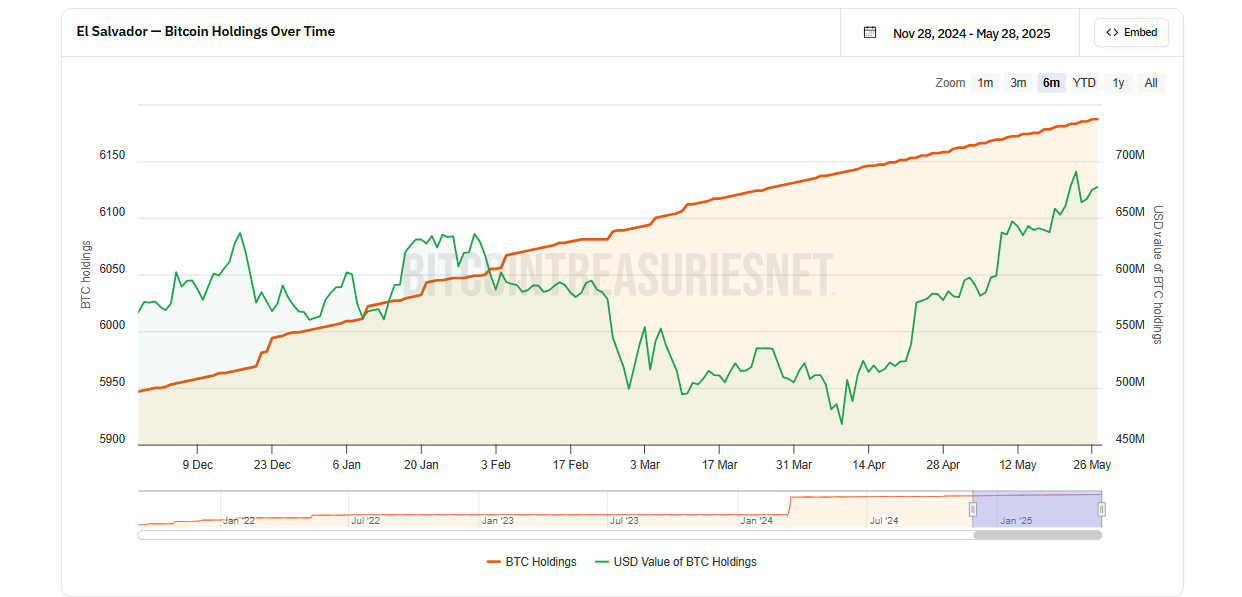

Nayib Bukele and El Salvador created a Bitcoin Reserve outside the public sector and have steadily accumulated the coin since August 2021.

The country now controls 6,189 BTC and may continue to acquire more, defying efforts by the International Monetary Fund (IMF) to halt this bold Bitcoin experiment.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

The IMF Wants El Salvador To Stop Buying Bitcoin

The tug-of-war between El Salvador and the IMF stems from a $1.4 billion Extended Fund Facility (EFF) loan agreement, which was finalized in December 2024 and is set to run for 40 months.

This standoff reveals an ideological battle over Bitcoin and crypto role in global finance. The IMF imposed several conditions as part of the loan agreement, including restricting El Salvador’s ability to buy more BTC.

Despite these constraints, Bukele’s government continues to purchase BTC, defying IMF pressure. In March, the president posted on X that they won’t stop buying BTC.

“This all stops in April.” “This all stops in June.” “This all stops in December.”

No, it’s not stopping.

If it didn’t stop when the world ostracized us and most “bitcoiners” abandoned us, it won’t stop now, and it won’t stop in the future.

Proof of work > proof of whining https://t.co/9pC0PoY3YQ

— Nayib Bukele (@nayibbukele) March 4, 2025

As of May 28, 2025, Bitcoin Treasuries data confirms El Salvador holds 6,189 BTC. Even after the December 2024 loan agreement, El Salvador has consistently added BTC, with near-daily purchases in 2025.

(Source)

President Bukele believes embracing Bitcoin bolsters their economic sovereignty, making it attractive to crypto-leaning investors, some of whom are involved in some of the best meme coin ICOs. Doubling down on Bitcoin also reduces reliance on traditional financiers like the IMF.

On the other hand, the IMF views El Salvador’s Bitcoin accumulation as a high-stakes gamble, arguing that the coin’s volatility threatens its fragile economy.

Accordingly, the IMF extended the $1.4 billion loan but targeted the country’s Bitcoin policy to stabilize El Salvador’s economy and boost its foreign reserves. The IMF demands that El Salvador make BTC acceptance voluntary for private businesses, effectively stripping its mandatory legal tender status.

Additionally, the IMF requires halting Bitcoin accumulation, publicizing government-controlled Bitcoin wallet addresses, liquidating the Fidebitcoin fund by July 2025, and winding down the state-run Chivo Wallet.

Nayib Bukele Defiant, Accumulating BTC

Nevertheless, El Salvador is openly flouting these restrictions.

By structuring the Bitcoin Office outside the official public sector, the country has continued to accumulate BTC despite IMF demands. Yesterday, on May 27, the office bought one more BTC.

EL SALVADOR JUST BOUGHT MORE BITCOIN pic.twitter.com/HlEJMkFIOW

— The Bitcoin Office (@bitcoinofficesv) May 28, 2025

Surprisingly, the IMF stated that El Salvador’s Bitcoin purchases remain “consistent” with the loan program’s conditions.

It remains unclear whether this softened response reflects the IMF’s need to maintain influence over El Salvador amid a shifting global crypto landscape, particularly following Donald Trump’s pro-crypto U.S. administration, or if it indicates leniency.

If the Bitcoin price surges above $120,000, or even $500,000, as predicted by Binance founder Changpeng Zhao in early May, it would vindicate Bukele.

(BTCUSDT)

However, a price drop, similar to the 2022 bear market, could increase pressure on El Salvador, giving the IMF greater leverage to dictate loan conditions.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

El Salvador vs. IMF: Bukele Defiant, Buying More Bitcoin

- El Salvador is defiant and is buying more BTC

- IMF extends loan but attached strict conditions targeting El Salvador’s Bitcoin policy

- Nayib Bukele is a firm believer in BTC, says buying won’t stop

- Will a rally to $120,000 and $500,000 vindicate the president

The post IMF Doubles Down on Bitcoin War Against Bukele’s El Salvador appeared first on 99Bitcoins.