India’s metals industry is confronting significant trade challenges due to recent global tariff adjustments, particularly from the United States. The escalation of import duties on steel and aluminum has placed billions of dollars in Indian exports at risk, prompting concerns among industry stakeholders and policymakers.

U.S. Tariff Increases and Their Impact

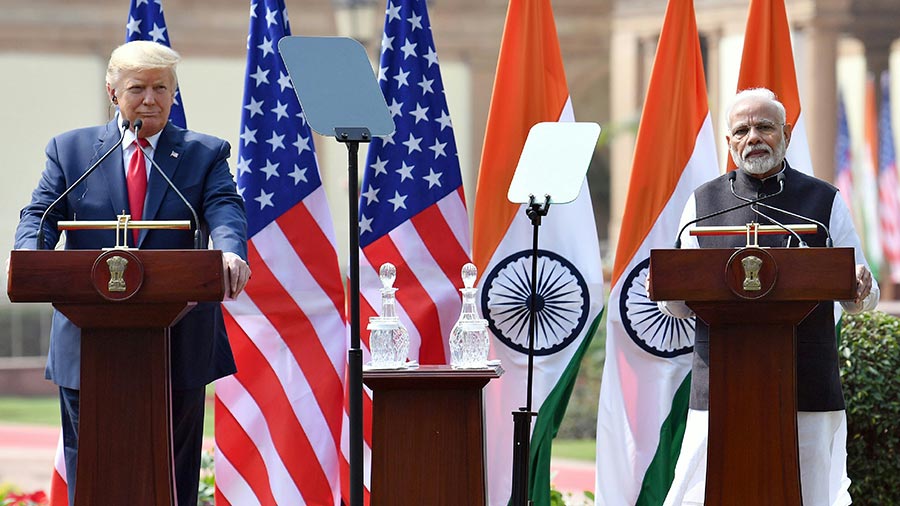

On May 30, 2025, U.S. President Donald Trump announced a decision to double tariffs on steel and aluminum imports from 25% to 50%, effective June 4, 2025. This move is anticipated to adversely affect India’s metal exports, which were valued at approximately $4.56 billion in FY2025. The breakdown includes $3.1 billion in articles of iron or steel, $860 million in aluminum and related products, and $587.5 million in iron and steel.

The Global Trade Research Initiative (GTRI) has highlighted that these increased tariffs could render Indian metal products less competitive in the U.S. market, potentially leading to a significant decline in export volumes.

Industry Response and Concerns

Leading Indian metal producers have expressed apprehension regarding the tariff hikes. Vedanta, a major aluminum producer, warned that the increased tariffs threaten the viability of India’s aluminum industry, which has seen over $20 billion in investments. The company has urged the Indian government to implement protective measures to shield the domestic sector from potential market disruptions.

Similarly, the Federation of Indian Export Organisations (FIEO) has raised concerns that the tariff escalation could adversely impact the export of value-added and finished steel products, including auto components and structural steel, which are integral to India’s export portfolio.

Global Trade Dynamics and Additional Challenges

Beyond the U.S. tariffs, India’s metals industry is navigating other global trade complexities. The European Union is considering stricter safeguard measures to protect its domestic steel industry, which may include increased import quotas and potential export duties on metal scrap. These measures are aimed at preventing a glut of foreign metals, particularly from countries like India and China, from destabilizing the EU market.

Additionally, India’s automobile industry is facing a potential production crisis due to a rare earth supply shortage following China’s export curbs. Electric vehicle manufacturers are particularly vulnerable, given their higher dependence on rare earth elements. While the Indian government is encouraging domestic exploration of these materials, immediate solutions are limited, making diplomatic engagement with China crucial.