Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

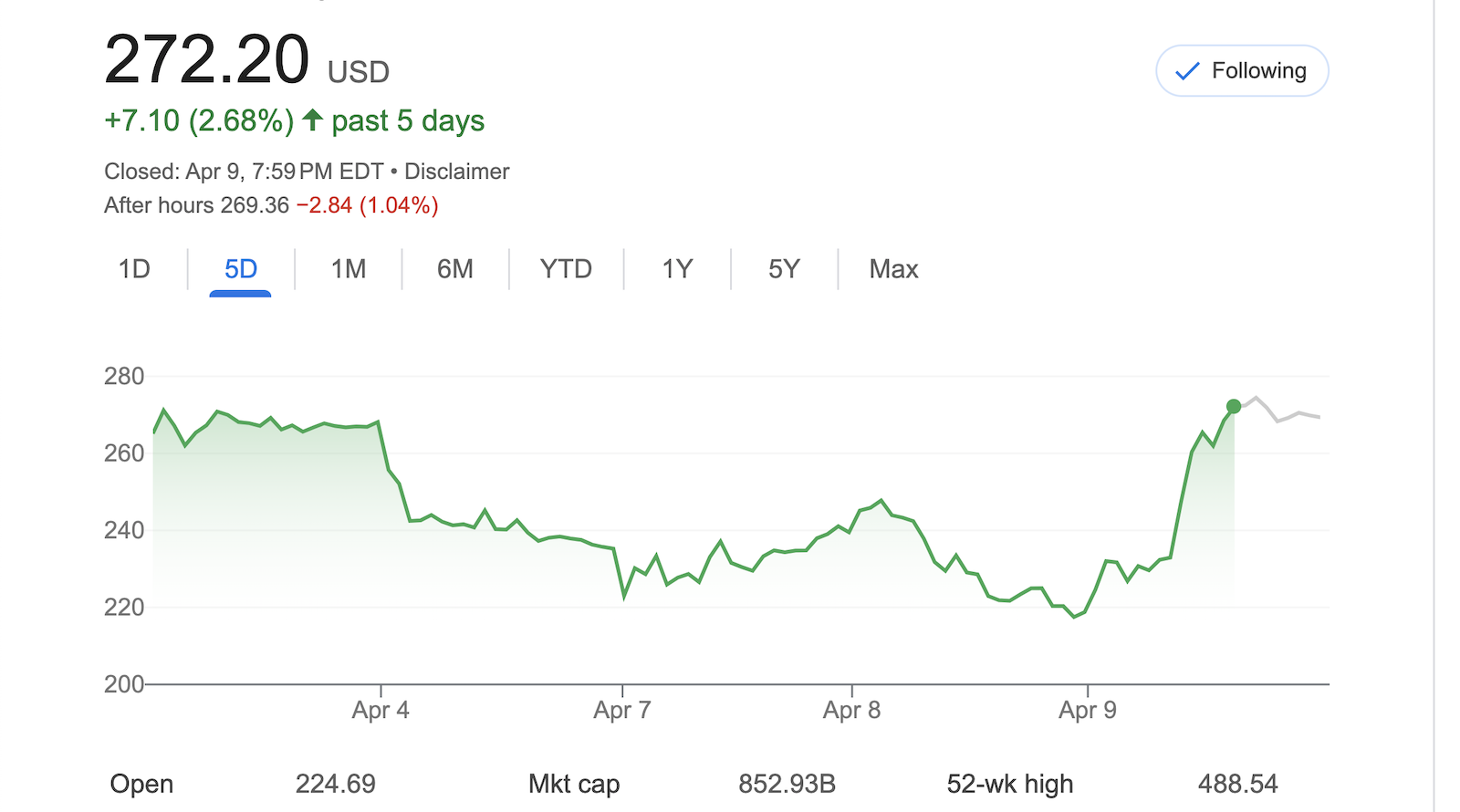

Tesla stock [NASDAQ:TSLA] is up almost 12% in the past 5 days. This is after a drop the week before, but even looking back one month, the stock is up 10%. This is despite a horrible Tesla quarterly report that showed worse financials than Wall Street was expecting, and a 71% drop in net income year over year.

Unsurprisingly, this has baffled many people. How do you have such a big drop in sales, have such a drop in income and profits, miss Wall Street’s expectations, and then get a stock price bump?

Streamlined Robotaxi/Driver Assist Reporting at Federal Level?

It appears it could be related to what Tesla has been promising us for the past decade or so — that robotaxis are just around the corner, and Tesla is going to make a killing on them. In particular, last Thursday, the US Department of Transportation introduced a new national framework for driver-assist systems in vehicles that streamlines some reporting requirements. Presumably, this would make it easier for Tesla to put robotaxis on the road, but it seems to me this is still a matter largely controlled by states — that they determine when to allow self-driving vehicles operate on their roads.

Still, this seems like the biggest potential catalyst for the stock rise. Though, I’ll cover a few other possibilities in a moment.

“This Administration understands that we’re in a race with China to out-innovate, and the stakes couldn’t be higher,” said Transportation Secretary Sean Duffy. “As part of DOT’s innovation agenda, our new framework will slash red tape and move us closer to a single national standard that spurs innovation and prioritizes safety.” That sounds good and all, but US requirements for driver-assist systems were already minimal. I don’t think regulations have been holding the US back on this front at all. In fact, Waymo has robotaxis on the road and driving paying passengers around in multiple states.

Tesla Robotaxis Finally Arriving?

Perhaps, beyond or associated with this, it was Elon Musk’s 10th year of promising a robotaxi revolution that got the stock going — and the fact that Tesla “robotaxis” will finally start operating this year. He said Tesla would be “selling fully autonomous rides in June in Austin, as we’ve been saying for now several months.” However, these are still going to include supervision from humans in the driver seats. So, you have to be pretty bullish about the company’s tech to expect a rapid rollout of actual robotaxis. Maybe many people are.

Elon Spending Less Time in White House?

Or maybe the stock got a growing boost from Elon Musk saying he’d spend less time on “DOGE” stuff in the Trump administration — maybe. There’s been a lot of backlash to that, as well as the fact that Musk is clearly directing his attention to a lot of non-Tesla stuff (even if he isn’t spending much time to research it and make well informed decisions regarding billions of dollars of federal spending). So, some people have become more optimistic about Tesla’s future with Musk promising, but not really promising, to step back from the political stuff and get back to work at Tesla. Others have pointed out that the brand damage is already done and there’s no going back, but the stock is up 10% not down 10%, so maybe more people think this means a lot.

The Finances Are Fine — Really

On the quarterly Tesla conference call, Musk didn’t seem to be fazed about Tesla’s huge drop in sales and financial slide. He pointed out that the company has really been on the razor’s edge several times in the past, and this is not one of those times. Maybe that calmed investors’ nerves and that was enough to boost the stock. Maybe people are largely buying the idea that Tesla’s huge drop in sales was just because they had to redo the production lines for the new Model Y in factories around the world. It seems to me that much more than that has been going on, and Tesla could continue to face serious demand challenges — maybe even soon. But perhaps a lot of investors are buying Elon Musk’s claims that all is fine at Tesla, financials are going to be fine, sales are going to be fine, etc., etc.

I would just keep in mind that Tesla was supposed to be growing at an average of 50% a year this decade, that has turned into sales declines, and the stock price hasn’t really taken a hit despite the massive shift. Do investors think there’s going to be a massive rebound with the new Model Y, with robotaxis, and with humanoid robots that is going to make up for the past year and a half of sales growth collapse? It seems to me that’s the idea. Never mind that Tesla wouldn’t have turned a profit last quarter if not for selling regulatory credits, and the fact that Donald Trump keeps attacking, defunding, and ending EV-supportive policies and would also like to end policies that provide Tesla with regulatory credits.

Something Else?

Perhaps it is talk of a cheaper Tesla model or two that has investors bullish about Tesla again. Perhaps it is the hype around humanoid robots. Perhaps it is the Tesla Semi, but that is reportedly delayed again. Perhaps it is just that Musk doesn’t seem to be in crisis mode and nothing notable is happening at Tesla (like mass firings), implying that all is actually going well.

Or maybe it’s just that after some investors sold off the stock, others who are constantly bullish on Tesla’s future no matter what happens feel emboldened to double down and “buy the dip.” It is a common refrain in the Tesla fan community to hype that phrase and provide social pressure to buy more stock anytime there’s bad news and the stock drops. The idea is that no matter what happens in the short term, Tesla is innovating faster than everyone else and the long term must be bright. (There’s a lot of evidence to the contrary, but fans either don’t believe that or block it out.)

Maybe there’s just a general sentiment that “it can’t get worse than this, and this isn’t so bad, so only up from here!”

I don’t know. I feel like I might still be missing something, but I assume it’s some combination of everything above that has lead to a gradual stock rise of 12% in the last five days and 10% in the last month despite an obvious financial bloodbath.

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy