XTB Reports Record $155M in Q1 2025 Revenue; Profits Remain Flat Amid Rising Marketing and Staffing Costs

International forex and CFD broker XTB reported $155 million in total revenue for the first quarter of 2025. Based on recent XTB financial results, this is the Polish brokerage’s strongest-ever revenue performance since its launch in 2004.

Despite the record-breaking XTB Q1 2025 earnings, the Polish trading platform’s high operational costs, mostly consisting of costs related to global expansion, customer acquisition, and tech investment, have stunted its net income. As XTB aims to expand its services further, investors will monitor how the company handles the global demand while managing its growing expenses.

XTB Hits Record $155M in Revenue in Q1 2025

Let’s break down the causes of XTB’s $155 million Q1 2025 revenue.

Surge in Trading Volumes Drives Topline Growth

One reason XTB’s revenue in 2025 skyrocketed was a significant increase in trading volume. In particular, the brokerage experienced a 25% increase in CFD lots traded (1.91 million lots) compared to 1.53 million CFD lots in Q1 2024.

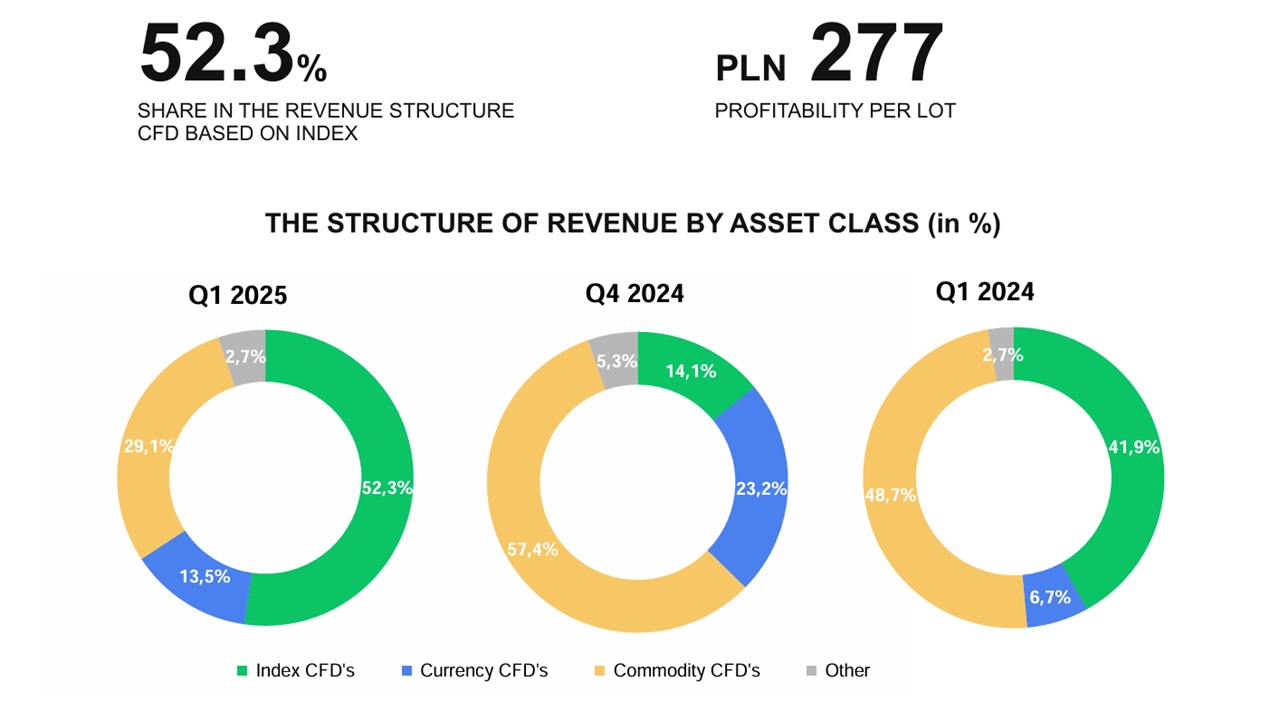

Breakdown of Revenue by Asset Class

According to the company’s latest financial report, CFD trading revenue accounted for most of its earnings by instrument class.

- CFDs based on indices had the largest revenue share at 52.3%, with German DAX index CFD and the American US 100 CFD profitability being significant factors.

- Commodity-based CFDs were the second most profitable, accounting for 29.1% of overall revenue.

- CFD forex trading volume in 2025 comprised 13.5% of the revenue, compared to 6.7% in Q1 2024.

Visit XTB

Profit Margins Flat as XTB Grapples with Rising Operating Costs

While revenue improved, XTB’s net profit remained flat due to a significant rise in operational expenses. These costs reached $83.6 million in Q1 2025, up from $70 million in Q4 2024 and $54 million in Q1 2024.

Marketing and Staffing Fuel Expense Hike

XTB’s marketing budget hit $37 million, a 74% increase year over year. A growth-oriented forex and CFD broker’s marketing spend is expected to be much higher compared to other expenditures.

An increase in the number of employees also added to overall costs, pushing salary and benefits up 30% compared to Q1 2024. Rising user deposits also led to higher payment processing fees.

Strategic Investment in Global Branding and Tech Infrastructure

The XTB Management Board has prioritized increasing its customer base and building its global brand to expand towards non-European markets. As a result, marketing costs are expected to increase by around 80% compared to the previous year.

Additionally, XTB has started various product innovations in 2025 with the launch of its eWallet service for users in Poland. Other significant offering changes include long-term savings products like the ISA (Individual Savings Account) for UK clients and the PEA account for French traders.

Client Acquisition at All-Time High

Regarding XTB client acquisition, the trading platform added more users in Q1 2025 than in any other quarter. With over 194,000 new sign-ups, the client base now exceeds 1.54 million.

194K+ New Clients Added in Q1 Alone

XTB recorded 194,304 new clients between January and March 2025, a 49.8% YoY increase. Key marketing campaigns, with broad reach through digital, TV, and billboard ad placements, were the main drivers of this growth.

Active Client Base Jumps 76% YoY

The number of active clients hit 735,389, representing a 76.5% increase from Q1 2024. During the quarter, these clients traded, held positions, or maintained account balances. In total, XTB has added over half a million new clients from the same time last year.

Why XTB is Popular Amongst UK Traders & Investors

Regulated by the UK Financial Conduct Authority, XTB continues to attract UK retail investors with its safe and convenient trading features. Zero-commission stock trading, low CFD spreads, and a user-friendly interface make it a competitive brokerage platform.

In line with online trading trends in 2025, XTB looks to support CFD crypto trading and ISA-compatible investment products to entice more UK clients. Furthermore, traders’ funds are protected by the Financial Services Compensation Scheme (FSCS), giving up to £85,000 per person if XTB becomes insolvent.

Getting Started with XTB in 2025

Here’s how UK residents can begin trading on XTB:

- Create an Account: Visit the XTB homepage and click ‘Open Account.’

- Verify your Identity: Upload proof of identity and address to complete the KYC (Know Your Customer) verification process.

- Deposit Funds: Transfer money via bank, debit, or credit card. Most deposits are processed instantly.

- Start Trading: Open a position on stocks, ETFs, currencies, or commodities through the xStation platform. You can also open your account through the mobile app to easily manage positions.

Depending on your deposit method, you may need to pay additional fees outside of the XTB platform.

Our Verdict on XTB

XTB’s Q1 2025 earnings reflect the trading platform’s ongoing client acquisition strategy and expansion into other regions. While higher operational costs have lowered XTB profit margins, the Management Board remains confident in developing its global brand and marketing initiatives.

Open an account with XTB today and find new investment opportunities with a trusted UK-regulated broker!

Visit XTB

FAQs

Is XTB legal in the UK?

Is my money safe in XTB?

Can we trust XTB?

Which broker is best for trading UK?

Is Forex trading banned in UK?

How do I withdraw money from XTB?

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Is XTB legal in the UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “XTB is a regulated trading platform authorized by the UK Financial Conduct Authority, allowing the site to offer trading services to UK traders legally.”

}

}

, {

“@type”: “Question”,

“name”: “Is my money safe in XTB?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “XTB user funds are well protected, following the UK Financial Conduct Authority guidelines. This includes the storage of retail client holdings in segregated bank accounts and up to £85,000 per person protection by the Financial Services Compensation Scheme (FSCS).”

}

}

, {

“@type”: “Question”,

“name”: “Can we trust XTB?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “As a leading forex and CFD trading platform with international licenses, XTB is considered a safe and convenient broker with over 1.5 million users.”

}

}

, {

“@type”: “Question”,

“name”: “Which broker is best for trading UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “XTB is one of the top trading platforms in the UK, thanks to its user-friendly design, competitive fees, and multi-asset offerings.”

}

}

, {

“@type”: “Question”,

“name”: “Is Forex trading banned in UK?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Forex trading is an entirely legal activity in the UK, with FCA-regulated brokers like XTB offering various currency pairs for trading.”

}

}

, {

“@type”: “Question”,

“name”: “How do I withdraw money from XTB?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “From your XTB account, open the withdrawal tab and enter the amount you wish to withdraw. Select your preferred method and click ‘Withdraw’ to initiate the process.”

}

}

]

}

References:

- XTB – Relacje Inwestorskie » XTB published Q1 2025 preliminary financial results. Record operating income and increased investor activity (XTB Q1 2025)

- XTB – Relacje Inwestorskie » XTB financial results for the 1st quarter of 2024 (XTB Q1 2024)

- RB-17-2025-Wstepne-wyniki-finansowe-i-operacyjne-za-I-kwartal-2025-ENG-all-1-3.pdf (XTB Q1 2025 Report)

The post XTB Reports Record $155M in Q1 2025 Revenue; Profits Remain Flat Amid Rising Marketing and Staffing Costs appeared first on 99Bitcoins.